Listen to podcast:

The most expensive sentence in Israeli real estate is usually the one that sounds the safest.

You know the line. You’ve heard it in sales offices, WhatsApp groups, and those “insider” voice notes that always start with, “Trust me.”

The pitch is simple: the war slowed construction, workers vanished, apartments won’t be ready, and when stability returns the market will snap back hard. So you should buy an apartment “on paper” now, lock a 2025 price, take delivery in 2027, and watch a 2026 spike do the heavy lifting.

It sounds inevitable. That’s what makes it dangerous.

Because the real story in Israel’s housing market isn’t “Will prices jump?”

It’s “Which thing is actually scarce right now… apartments, or certainty?”

The pitch that sells itself

Let’s translate the jargon first.

Buying “on paper” (also called off‑plan or pre‑construction) means signing a contract for an apartment that isn’t finished yet. Sometimes the building isn’t even out of the ground. You’re buying a promise: a floor plan, a future delivery date, and a developer’s ability to execute.

The sales logic is intoxicating:

Pay a smaller amount now, pay the rest later, and by the time you get the keys you’ll have “automatically” gained value.

And here’s the twist people don’t expect: parts of that story are genuinely grounded in real data.

Israel’s own central bank has said the construction sector faced a labor shortage after the war began, and that the visible result was longer timelines and fewer completed homes being delivered.

So if the disruption is real… why does the “guaranteed win” still feel like a magician’s trick?

The part that’s real and why it matters

The slowdown wasn’t because Israel forgot how to build. It was because building is brutally physical, and the people who do the hardest, most specialized early-stage work weren’t there.

Reuters described how the workforce on some sites collapsed after October 7, with large numbers of Palestinian workers no longer entering Israel for security reasons, leaving a major hole in construction labor.

When “tens of thousands of hands” disappear from an industry that runs on manpower, you don’t just slow down. You change the entire rhythm of delivery.

Here’s a term most buyers mix up:

- Starts are when a project begins.

- Completions are when homes are finished and can actually be handed over.

Starts are announcements. Completions are keys.

And the Bank of Israel’s point was basically: the delivery side is where the stress showed up.

So far, the pitch sounds solid.

But now the story flips.

Starts didn’t disappear. They moved.

If someone tells you “construction froze,” don’t argue. Just ask one question:

Which time window are you talking about?

Because CBS-based reporting in Israel has shown permits and starts rising over certain 12‑month stretches even while completions were softer. Translation: projects can be launched while delivery still lags behind.

That one detail matters because the “2026 spike” narrative depends on a clean chain reaction:

Less building → fewer apartments → sudden shortage → prices rocket.

But Israel is rarely a clean chain reaction. It’s overlapping forces moving at different speeds:

demographics pushing demand up, interest rates pushing demand down, and construction capacity trying to recover in the middle.

So what’s the one number that tells you whether the market is truly “starving” for apartments?

It isn’t starts.

It’s what’s sitting on the shelf right now.

The number that makes people uncomfortable

Unsold inventory (sometimes called “unsold new dwellings”) is exactly what it sounds like: new apartments that are available for sale but haven’t sold yet.

By late 2025, CBS data reported in Israeli media put unsold new-apartment inventory in the mid‑80,000 range, with monthly sales far below that pile.

And there’s a simple way to make that feel real without sounding like an economist:

Months of supply means:

“If nobody bought faster than they’re buying today, how many months would it take to clear what’s sitting unsold?”

That late‑2025 stock worked out to roughly two and a half years of supply.

So when someone tries to rush you with “a guaranteed shortage is coming,” but the market is sitting on years of unsold stock, you’re not in a clean shortage story.

You’re in a timing story.

And timing is where forecasts turn into faith.

Why a 2026 spike is possible and still not a plan

Could Israel see a sharp housing move after stability improves? Yes. That’s not crazy.

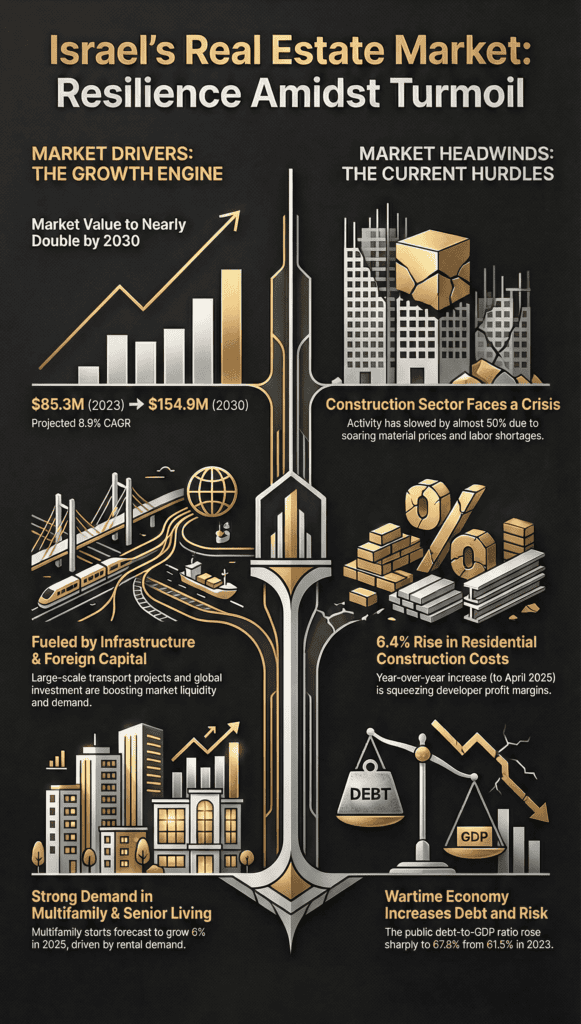

Israel has long-term demand drivers that don’t vanish just because the headlines are heavy: a growing population, immigration, and a country where high-demand areas are geographically tight. That’s the pro‑Israel reality a lot of outsiders miss: the underlying demand engine is stubborn.

But “possible” is not “scheduled.”

A 2026 spike depends on multiple dials turning the same direction at the same time:

Interest rates

Mortgage costs don’t come from the sky. They’re heavily influenced by the Bank of Israel’s policy rate (the central bank rate that affects what banks charge borrowers). As of late 2025, even after a small cut, the policy rate was still above 4%. That’s not cheap money, and expensive money can keep buyers on the sidelines.

Confidence

People don’t buy homes purely with spreadsheets. They buy with nervous systems. If families and investors are still anxious, demand doesn’t “explode” on command.

Labor normalization

If manpower returns slowly, completions stay slow. If manpower returns quickly, delivery pressure eases.

Developer behavior

If developers keep launching projects and discounting to move inventory, “shortage” can stay a future story longer than anyone expects.

That’s why smart analysts can look at the same market and argue opposite outcomes.

One sees delays and says “shortage.”

Another sees unsold stock and says “glut.”

Both can be right depending on the month you measure.

So if you’re tempted by the off‑plan pitch, the real question gets uncomfortable fast:

Are you investing in Israel’s long-term story… or are you betting on one developer’s timeline?

The off‑plan math nobody puts in the brochure

Off‑plan deals are marketed like a cheat code: put money down now, wait, then collect appreciation.

But three “boring” realities decide whether it’s a smart move or a slow-motion headache.

Delivery risk

Delivery risk means the apartment arrives later than promised.

When build times stretch, a “2027 delivery” can quietly slide into 2028. Not necessarily because someone lied. Because construction is a chain: one missing trade slows the trades behind it.

CBS-based reporting has shown construction duration hovering around the mid‑30‑month range on average. Averages hide the painful truth: some projects land far to the right of that number.

Why this matters financially is simple: delays create overlap.

Overlap is when you’re still paying rent (or another mortgage) while also carrying costs tied to the new purchase. Even a “small” delay can erase the profit you thought was waiting for you in 2026.

The indexation surprise

This one shocks first-time buyers.

Many Israeli new-build contracts don’t keep the real price perfectly fixed. Part of the unpaid amount can be linked to a published index called the Price Index of Input in Residential Building (people often call it the construction inputs index).

Plain-English explanation:

It’s like agreeing to buy a kitchen remodel where the final bill moves with labor and material costs. If construction costs rise while your apartment is being built, the amount you owe can rise too.

Israel’s Central Bureau of Statistics publishes and updates these indices and even provides indexation calculators.

So when a salesperson says “you’re locking in today’s price,” your next question should be:

What part is truly fixed, and what part moves with an index?

That one sentence can save you more money than any argument about 2026.

Developer survival risk

Most people understand “market risk.” Fewer people think about counterparty risk.

Counterparty risk means the other side of your deal might not survive long enough to finish it.

In a higher-rate environment, smaller developers can get squeezed: slower sales, higher financing costs, and construction delays that choke cash flow.

Israel does have buyer protections, including regulated bank guarantees linked to apartment purchase protections under the Sale Law framework. But even when money protections exist, timelines can still get messy.

Your deposit might be protected. Your time, stress, and plans might not be.

And that’s the cost nobody writes in bold font.

Buying in Israel without getting played

Here’s the pro‑Israel angle I actually respect: Israel rewards people who respect reality.

Not pessimists. Not cheerleaders. Adults who read the data and the contract.

If you want to buy and feel good about it, do this before you argue with anyone about “what will happen in 2026.”

A quick due‑diligence checklist

- Separate starts from completions

Starts tell you developer activity. Completions tell you what actually reaches the market. The Bank of Israel has pointed directly to labor constraints extending timelines and lowering completions. - Check unsold inventory before you believe any scarcity story

If inventory is high, urgency is often a sales tactic, not a market fact. - Stress-test overlap

Run one uncomfortable scenario: “What if delivery slips by 9–12 months?”

If that breaks you financially, it’s not an investment. It’s a trap. - Ask the indexation question in writing

Which index? What percentage is linked? Is there a cap?

Vague answers are not “flexibility.” They’re hidden pricing. - Confirm bank guarantees and structure

Don’t accept “it’s fine.” Know what protection exists and how payments are safeguarded. - Use official stats like a pre-flight checklist

Israel has unusually transparent institutions for a country living through instability. Bank of Israel and CBS publish real numbers. Use them before you sign.

The ending nobody expects

The off‑plan pitch wants you obsessed with the year.

But the year is a distraction.

In Israel, the real lever is the contract line that decides whether your price moves, the clause that decides who eats the delay, and the guarantee that decides whether you sleep at night.

Israel’s long-term housing story is real. The resilience is real. The demand drivers are real.

The “guaranteed spike” is not.

So if you’re going to buy, don’t buy the prophecy.

Buy the terms.

Quick SEO notes you can copy-paste

Suggested meta title

Israel Housing Market 2026 and the Off‑Plan Trap

To sum things up

- The construction slowdown story has real roots: Israel’s central bank and major reporting describe labor disruption, longer build timelines, and weaker completions.

- Starts and permits have not been a straight-line collapse, which makes “shortage” a question of delivery timing, not just “projects launched.”

- Unsold new-apartment inventory was still extremely high in late 2025, which weakens any “inevitable 2026 spike” story.

- Off‑plan deals can bite through delays, index-linked price creep, and developer risk, even if the headline price looks “locked.”

- If you believe in Israel’s long-term strength, buy with due diligence and hard questions, not with slogans and calendar-year predictions.