The Problem: In Israel, looking at yad-2 listings or historical transaction data (comps) often fails to capture the massive upside in transitional zones. Comps tell you what a property is worth in a construction site; they don’t tell you what it’s worth the day the Light Rail (Dankal) opens.

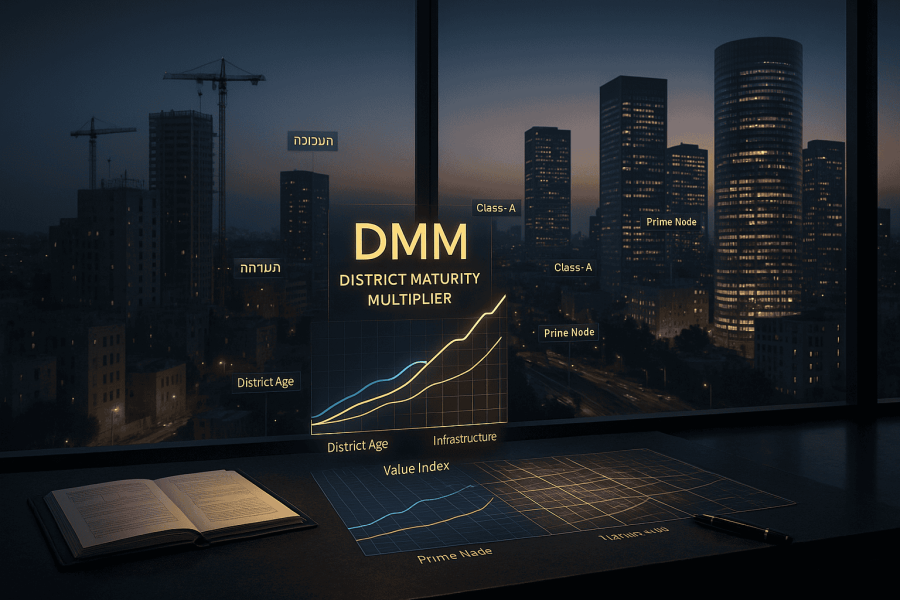

The Solution: The District Maturity Multiplier (DMM). This is a factor applied to today’s shell value or NOI to quantify the “maturity premium”—the jump in value that happens when a chaotic development zone stabilizes into a prime district.

1. The Inputs (The “Maturity Scorecard”)

Score each from 0 (Absent) to 3 (Fully Operational).

-

Infrastructure (LRT/Metro/Roads): Is the Light Rail (Red/Green line) running? Is the Route 16 entrance open? Is the streetscaping complete?

-

Anchor Tenants: Are the “Magnets” open? (e.g., Government offices, Mobileye/Google HQ, a major hospital expansion, or a Big/Azrieli center).

-

Institutional Ownership: Are the big players here? (e.g., Amot, Gav-Yam, Reit 1). When insurance companies buy in, the risk premium drops.

-

Vacancy Compression: Is local vacancy trending down over the last 3 years?

-

Pipeline Absorption: Is the crane-filled skyline already pre-leased, or is it speculative?

-

Amenity Density: Is there a workable ecosystem within a 10-min walk? (Aroma/cafes, Super-Pharm, gyms, green space).

-

Policy & Arnona: Is the Taba (zoning) locked? Are there municipal incentives (reduced Arnona for Hi-Tech)?

-

Safety & Maintenance: Has the municipality taken over maintenance? Is the street lighting and sanitation up to “Class A” standards?

-

Brand Perception: has the area shifted from “Garage District/Industrial Zone” to “Business Hub” in the press?

2. The Weighting (Israeli Office/Mixed-Use)

In the Israeli market, infrastructure and ownership drive value most aggressively.

| Factor | Weight |

| Infrastructure (LRT/Access) | 25% |

| Anchor Tenants | 20% |

| Institutional Ownership | 15% |

| Vacancy Trend | 10% |

| Pipeline Absorption | 10% |

| Amenity Density | 10% |

| Policy/Zoning | 5% |

| Safety/Cleanliness | 3% |

| Brand Perception | 2% |

3. Calculate the Multiplier

Step A: Get the Readiness Index (R)

$R = sum (Weight times frac{Score}{3})$

(R runs from 0 to 1)

Step B: Convert to DMM

For the Israeli market, where volatility is higher, use a conservative curve:

(Floor: 1.00 | Ceiling: 1.35)

4. Real World Example: Jerusalem Gateway (Knisa L’Ir)

Hypothetical scenario for a floor in a new tower currently under construction.

The Scores:

-

Infrastructure: 3/3 (Navon train station & Red Line active).

-

Anchors: 2/3 (Courts & gov offices planned/building, but not all occupied).

-

Institutions: 2/3 (Major funds are buying, but still some private ownership).

-

Amenities: 1/3 (Still feels like a construction zone, few cafes yet).

-

…remaining scores average out…

The Math:

-

Let’s say the weighted calculation gives an R of 0.60.

-

$DMM = 1 + (0.5 times 0.60) = mathbf{1.30}$

The Valuation:

-

Current “Dust & Noise” Market Price: 21,000 NIS per sqm (Shell/Ma’atefet).

-

Mature District Value: $21,000 times 1.30 = mathbf{27,300 text{ NIS per sqm}}$.

-

The Upside: If fit-out costs 5,000 NIS/sqm, your total cost is 26k. If the market trades prime finished offices at 32k+, the DMM confirms you have a safety margin.

5. How to Use This in Underwriting

-

Rent Steps: Don’t just CPI-index (Madad) the rent. Model a “Maturity Jump” in year 3 or 4 when the infrastructure completes.

-

Formula: Future Rent = Current Rent $times$ DMM.

-

-

Cap Rate Compression: If the area is currently trading at a 7% cap because it’s “emerging,” use the R-score to justify exiting at a 6% cap once the “Institutional Ownership” score hits 3/3.

-

The “Pre-Sale” Pitch: When selling on paper, show clients the DMM to explain why paying today’s price is a discount on tomorrow’s reality, not just a gamble.

Guardrails (The “Don’t Be Naive” Rules)

-

The “Tabu” Rule: Never score Policy/Zoning above 1 unless the Taba is approved and fees are paid.

-

The “Shovel” Rule: Infrastructure gets a 0 score until you see tractors on the ground. Plans in Israel can be delayed for years.

-

Cap the DMM: Never exceed 1.35 (35% lift) purely on district maturity. Anything higher requires unique asset-level improvements.