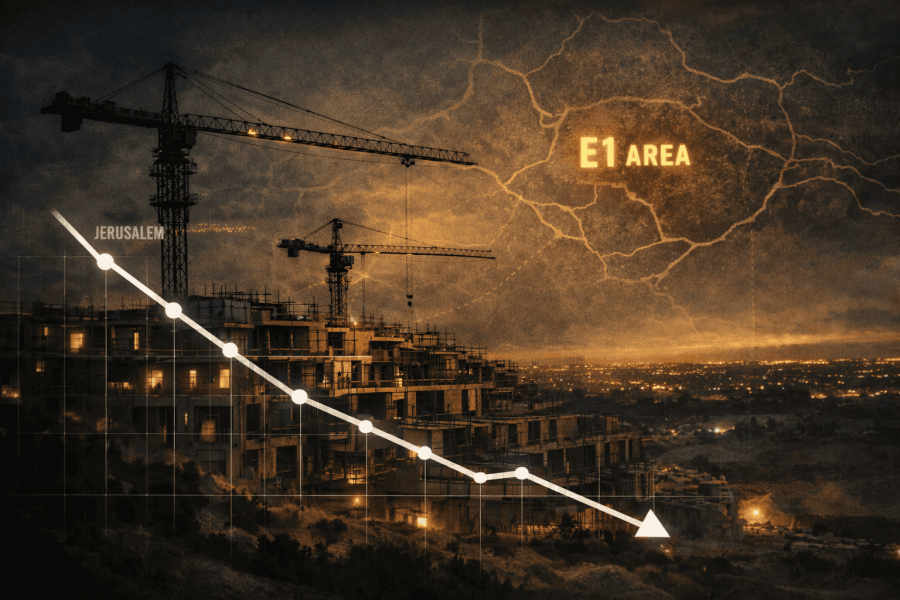

After years of diplomatic freeze, Israel has cleared key procedural hurdles for a major housing plan in E1, a land corridor east of Jerusalem. The step reignites a familiar global dispute while colliding with softer domestic signals, where recent Finance Ministry figures have pointed to a slowing pace of home sales.

What matters right now

- A long stalled E1 housing tender has moved closer to construction.

- Settlement related housing tenders have accelerated, drawing sharp international pushback.

- Critics argue the E1 move could reshape territorial contiguity, and Israel’s critics are mobilizing diplomatically.

- Separate transaction data suggests Israeli housing demand is not roaring back yet.

Israel clears a key hurdle for the E1 housing tender

Israel has approved the final procedural step before construction can begin on a housing plan in E1, a planning area east of Jerusalem. A tender, meaning a formal government call for developers to submit bids, has been issued for 3,401 housing units, marking a tangible shift from planning to execution after years of delay.

For Israel, the significance is not only the scale. It is the signal that the bureaucracy is moving. Tenders are where policy becomes practical reality: budgets, builders, and timelines.

The move immediately drew attention because E1 has long been treated as a geopolitical tripwire, not just another housing file.

Why does E1 ignite such fierce international scrutiny?

Opponents argue the E1 plan could effectively split the West Bank’s north and south, complicating the prospect of a territorially contiguous Palestinian state. That claim is why the project has repeatedly triggered international opposition and urgent diplomacy whenever it appears to be advancing from paper to ground.

This is the core tension: a housing tender on its face, a borders-and-sovereignty battle in practice.

Even among Israel’s allies, coverage highlights concern that construction would reshape facts on the ground in ways that are hard to reverse, and easier to escalate than to negotiate.

Settlement tenders hit a record pace, with more projects near Jerusalem

Alongside the E1 step, reporting describes an acceleration in the broader settlement housing pipeline, with more than 9,600 housing units put out to tender by the end of 2025 and additional projects discussed near East Jerusalem and beyond. The tempo matters because it reframes E1 as one part of a wider push, not a one off exception.

One way to understand scale is proportional: the share is calculated by dividing the E1 unit count by the reported total tendered units for 2025, which puts E1 at roughly one third of that cited annual tender volume.

That is why the debate is expanding. Critics are not reacting only to a single plan, but to what they see as momentum.

Can a soft transaction market absorb a bigger building agenda?

While policy headlines focus on tenders and approvals, recent market data points in the opposite direction: Finance Ministry figures reported a sharp slowdown in sales, including a 32% drop in January 2025 compared with the prior month, with weakness spanning both new homes and resales. That backdrop complicates the near term economics of bringing large new supply to market.

In plain terms, construction pipelines can surge even when buyers hesitate. That gap is where inventories build, incentives rise, and developers become more cautious about launch timing.

For households, a cooler sales market can mean more negotiating power, but also more uncertainty about where prices settle next.

| What changed | Why it matters now |

|---|---|

| E1 moved from long stalled planning into a live tender phase | Raises the probability of real construction, and intensifies diplomatic pressure |

| Settlement housing tenders accelerated in volume and frequency | Signals a broader policy direction that shapes expectations and risk |

| Transaction momentum has softened in the wider housing market | Suggests demand may not match supply ambitions in the near term |

What to do next

- Track tender milestones, including bid deadlines and any published updates to scope or phasing.

- Separate politics from timing: approvals can move faster than construction, and construction can move faster than absorption.

- Use official transaction releases and large outlet reporting to monitor demand, not social media claims.

E1 is a planning corridor located east of Jerusalem. It has become a major focal point in housing policy discussions and in international political disputes because of its strategic location.

A tender is a formal government process in which developers are invited to submit bids to build a specific, clearly defined project.

Contiguous means territory that is physically connected without breaks. The term is often used in debates about whether a future Palestinian state could exist as a geographically continuous area.

A settlement is a residential community located beyond Israel’s pre 1967 lines. These communities are central to a long running legal and diplomatic dispute.

A resale refers to a home that is sold by an existing owner rather than a newly built unit sold directly by a developer.

Questions people are asking

What exactly changed this week on E1?

Israel cleared the final procedural hurdle and the project is now in a tender phase, which is the step that invites real bids from developers and can unlock on the ground execution.

Does a tender mean construction is guaranteed?

No. A tender is a serious move from planning into procurement, but projects can still face delays through legal challenges, political decisions, or practical constraints that emerge once bids are evaluated.

Why do critics say E1 could split the West Bank?

Opponents argue E1’s geography could interrupt north to south territorial continuity, making the contours of a future Palestinian state harder to draw as a connected map.

How does the E1 move relate to wider settlement activity?

Le Monde describes E1 as part of a broader acceleration in settlement related housing tenders, framing it as a shift in tempo rather than an isolated file.

What does the slower sales data change for buyers and developers?

It changes leverage and timing. If transaction volume is falling, developers tend to be more selective on launches, while buyers can sometimes negotiate more aggressively, especially when inventory rises.

Is this mainly a political story or a real estate story?

It is both. The mechanism is real estate, but the stakes are political: sovereignty, borders, and international diplomacy are driving the intensity around what is, at the surface, a housing procurement process.

Where this goes next

Watch for two signals, not one. The first is bureaucratic: tender progress, awards, and any updated approvals. The second is market reality: whether transaction activity recovers enough to absorb additional supply. Together, they will determine whether E1 becomes a headline that fades, or a project that reshapes expectations on the ground.

The bottom line

- E1 has shifted closer to execution through a live tender process.

- International opposition is intensifying because E1 is viewed as strategically consequential.

- The broader tender pipeline is accelerating, which changes how E1 is interpreted.

- Housing demand signals remain soft, creating tension between supply ambition and market absorption.