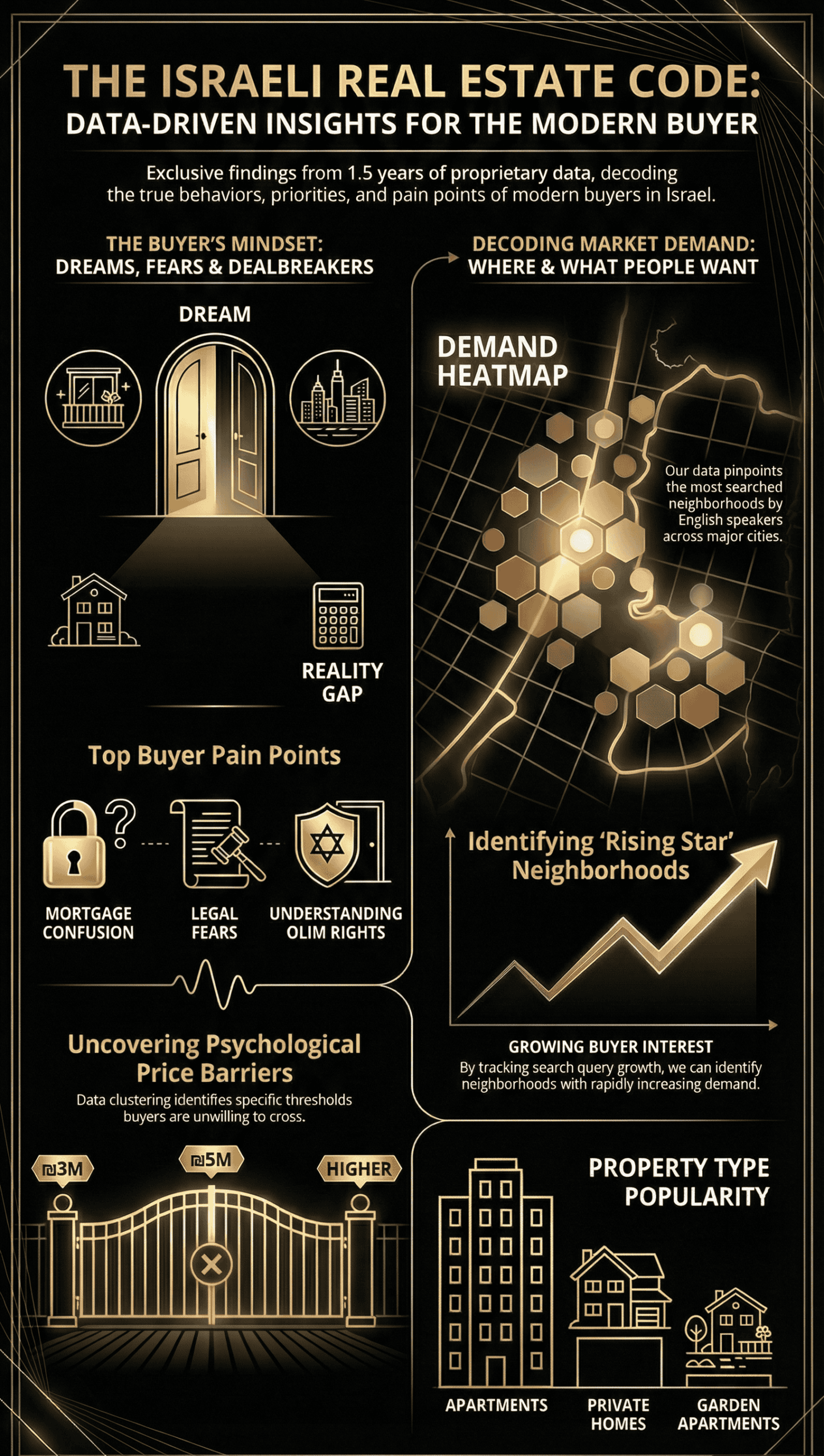

Everyone thinks Israel’s housing story begins and ends in Tel Aviv. Our private trail of real searches, real inquiries, and real pre decision questions tells a different tale: family hubs beat luxury headlines, neighborhood names outrank city names, and paperwork can matter more than paint colors. Ready for the market’s quiet center?

The Map in One Breath

- The hottest signals are not where prices are highest, but where people repeatedly ask the same next step questions.

- Israel’s demand is hyper local: a few neighborhoods absorb most attention inside each city.

- Diaspora interest is not a side note; it is a structural force in how Israel real estate gets researched.

- Budgets do not spread smoothly; they cluster at round numbers, then break hearts at the edges.

- The strangest inquiries expose a new expectation: people want Israel property knowledge to behave like a 24/7 local guide.

Listen to podcast:

Israeli Real Estate Demand and Market Heatmap Analysis – Table

Ramat Beit Shemesh Aleph

Beit ShemeshNeve Shamir

Beit ShemeshOld North

Tel AvivRamat Eshkol

JerusalemCarmei Gat

Kiryat GatRamat Poleg

NetanyaMishkafayim

Beit ShemeshNeve Tzedek

Tel AvivGivat Olga

HaderaMaalot Dafna

JerusalemRBS Hei

Beit ShemeshRBS Gimmel

Beit ShemeshIr Yamim

NetanyaArnona / Talpiot

JerusalemGivat Hamivtar

JerusalemRamat Shlomo

JerusalemCarmel Center

HaifaAfridar

AshkelonFlorentin

Tel AvivRamat Aviv

Tel AvivKerem Hateimanim

Tel AvivRBS Daled

Beit ShemeshKfar Shmaryahu

HerzliyaExclusive findings

Israel’s demand map starts with a plot twist

City level attention in our data does not crown the usual headline champion. The loudest demand signal comes from a family oriented hub, while the most famous city plays a different role: aspirational, researched, and often postponed. The suspense is not which places matter. It is why the funnel behaves differently by city.

The first surprise is concentration. A tiny set of cities absorbs the majority of location page clicks.

And the second surprise is the Anglo gravity effect: when English language buyers and renters search, they often prioritize community logic over skyline logic.

Here is the city heatmap from 16 months of demand signals (search clicks on city pages):

- Beit Shemesh: 9,464

- Jerusalem: 5,700

- Tel Aviv: 3,159

- Carmei Gat: 1,451

- Netanya: 703

Those five are not just popular. Together, they swallow almost all city page attention in the dataset.

Do neighborhoods matter more than cities in Israel?

Yes, dramatically. Neighborhood intent behaves like a magnet, not a mist. In our neighborhood level search data, the top 10 neighborhoods capture roughly three quarters of all neighborhood clicks, and within major cities, two to four neighborhoods often dominate the entire city’s neighborhood demand. People do not want Jerusalem. They want a specific Jerusalem.

Neighborhood demand is not evenly distributed. It is spiky. That spike tells you what fit looks like in Israel.

Top neighborhood hotspots by search clicks:

- Jerusalem: Ramat Eshkol (595), Maalot Dafna (89)

- Beit Shemesh: Mishkafayim (294), Ramat Beit Shemesh Gimmel (266), Ramat Beit Shemesh Hei (251), Ramat Beit Shemesh Aleph (167), Sheinfeld (74)

- Coast and beyond: Ramat Poleg (Netanya, 247), Givat Olga (Hadera, 212)

- Tel Aviv: Neve Tzedek (90), Florentin (64)

Inside city comparisons are blunt. In Jerusalem, the top two neighborhoods account for about 90% of Jerusalem’s neighborhood clicks in our tracked set. In Beit Shemesh, the top four account for about 89%. That is not interest. That is a shortlist.

A useful rising star tell is when engagement outpaces clicks. Some neighborhoods draw fewer search clicks but disproportionately high repeat viewing, suggesting deeper consideration once discovered. In our engagement ratios, Florentin and Ahuza show this stickiness pattern.

Curiosity vs commitment is where the real story hides

Clicks reveal curiosity. Leads reveal commitment. When you put them side by side, Israel’s funnel stops looking linear and starts looking strategic: one city dominates research volume, another dominates ready to talk behavior, and a third quietly overperforms on serious intent. This is the gap public reports almost never show.

City interest (search clicks on city pages) does not equal most likely to inquire.

In our inbound lead counts tied to locations, Jerusalem produces the most leads (108). Haifa is the quiet shocker (64), nearly matching Beit Shemesh’s lead count (63) despite far fewer city page clicks.

That mismatch signals two different realities:

- High curiosity hubs (research heavy) need expectation setting: budgets, availability, timelines.

- High commitment hubs (lead heavy) need transaction clarity: process, paperwork, legal steps.

If you have ever wondered why a city feels hot online but does not translate into decisive action, this is the pattern.

The diaspora corridor is shaping Israel’s housing map

Israel real estate demand is global by default. In our search click data, Israel accounts for about 41% of clicks, while the U.S. alone contributes about 33%. Mobile drives about 60% of clicks, turning life decisions into thumb scroll moments.

This matters because remote research changes the proof people demand.

When you are buying or renting from abroad, you need confidence before you need a key. That is why procedural questions spike: ownership verification, funds transfer, taxes, and how leases actually work.

The most common diaspora origin cities in our user location data include New York (5,097 users) and London (2,154 users).

The mobile pattern is also revealing: mobile click share is far higher than its impression share, and mobile CTR is over five times desktop CTR. That is a signal that the most click worthy queries are happening on phones: fast, personal, and often urgent.

Budget cliffs and round number psychology

Budgets do not behave like averages. They behave like thresholds. In our lead data, the raw buyer median is ₪1,000,000 while the mean is about ₪1.93M, exposing a dream vs reality gap. After filtering out obviously non purchase entries (very small numbers), the buyer median doubles to ₪2,000,000. Rent budgets cluster hard at ₪5k, ₪8k, and ₪10k.

Two overlooked truths sit inside those numbers.

First, round numbers are psychological anchors. About 65% of renter budgets land on exact ₪1,000 increments. For buyers (after cleaning), about 88% land on exact ₪100,000 increments. People do not arrive with market price. They arrive with a mental ceiling.

Second, the gap is not just between people and prices. It is also between people and their own next step. Many early budgets are search filters, then reality forces a revised plan.

Rent is the clearest example. Among renters who entered a budget, about 82% are at or below ₪10,000 per month. That one number explains why so many conversations pivot from central plus new plus furnished plus spacious to what trade off hurts least.

The Questions Index shows what matters before money moves

When people are close to action, their questions get specific and surprisingly repetitive. Our chat intent mix shows renting slightly outpacing buying, while a large other bucket reveals demand for clarity that sits outside listings: terminology, legal worries, Aliyah eligibility, senior living contracts, and even construction employment. These questions are the market’s real pulse.

Below are the question clusters that repeatedly surfaced across chats and inquiry logs.

Renting rules that surprise newcomers

Most rental stress in Israel comes from invisible rules, not visible apartments. People ask about deposits, who pays which bills, and what a listing price truly includes. They also collide with Israel’s room counting, and learn that timing matters: many rentals appear only shortly before move in, forcing fast decisions.

In Israel, advertised rent often is not the full monthly burden. Tenants commonly face extra payments like Arnona (municipal property tax) plus utilities, and buildings may have ongoing fees. See Arnona guidance here: Tel Aviv Yafo Municipality

Budget realism shows up in the micro examples people ask for:

- Beit Shemesh inquiries around ₪3,200 to ₪4,200 (studios and 1 bedroom)

- Holiday rentals near Machane Yehuda with $5,500 to $6,500 budgets

- New, furnished three room rentals in Kiryat Yovel

The lesson is not raise your budget. It is define the non negotiables early, or the market will define them for you.

Buying in Israel: compliance first, keys second

Buyers do not just ask what is the price. They ask how do I do this legally. The recurring blockers are proof and process: how to buy as an overseas buyer, how to verify ownership, and why banks and lawyers require a Source of Funds Declaration. Many also ask about Mas Shevach (capital gains tax) and exemptions.

Ownership verification comes up constantly. In Israel, requesting a land registry extract (often called a Tabu extract) is a practical due diligence step. Official service: Gov.il land registry extract

On the sell side, Mas Shevach (capital gains tax on profit) appears as a recurring worry, but many sellers may qualify for partial or full relief depending on personal circumstances.

Investing conversations are moving from Is now good to IRR

Investor intent shows up when questions stop being emotional and start being mathematical. Instead of should I buy now, people ask for IRR, Internal Rate of Return, a measure that blends cash flow timing with profit. In our question index, the most common investor requests are strategy comparison, typical IRR, and what data are you using.

In the dataset’s investor tiering, expectations cluster into three bands:

- Solid buy to let: about 4% to 7% IRR

- Value add: about 7% to 10% IRR

- Small scale development including TAMA 38: about 10% to 15% IRR

TAMA 38 is the phrase that triggers both excitement and caution. It refers to an urban renewal framework tied to seismic reinforcement, and it changes timelines, risk, and upside.

The subtext: Israel investors are looking for frameworks, not fortune telling.

Senior living, kibbutz housing, and other edge markets

Some of the most urgent Israel real estate decisions do not start with a 3 bedroom. They start with aging parents, contract clauses, and time pressure. Users repeatedly ask how Diur Mugan works (assisted living with a deposit model), what tenancy for life really means when care needs rise, and whether certain kibbutzim accept non members for long term living.

Diur Mugan is often structured around a Pikadon, an upfront deposit, plus monthly payments, with complex rules on depreciation and care upgrades. That is why families ask what happens when a resident needs more expensive care later.

Beyond that, niche questions show Israel’s market breadth:

- Can I buy land in Israel for ₪350,000?

- How much do cemetery plots cost at Eretz Hachaim?

- Which kibbutzim allow non member residents?

These are not edge curiosities. They are life planning decisions with legal consequences.

When people treat support like a concierge, expectations change

A surprising slice of conversations is not about property at all. It is about how people expect information to work. Users ask to retrieve past chats, complain when a link fails, or challenge why they are asked follow up questions after requesting listings. Others go fully off topic. It is a demand signal for clarity and boundaries.

This matters because it explains frustration patterns.

When someone wants a listing, but the next question is about budget, move in date, or location, it can feel like delay. In reality, those questions are the filter that prevents wasted time.

The off topic requests are oddly useful too. They show that for many people, Israel real estate help has become synonymous with Israel life help.

Seasonality and demand shifts you can actually plan around

Israel real estate interest has a calendar, even when prices do not. In our time series clicks, summer months led the year’s peaks, while holiday adjacent searches (Pesach, Sukkot) show up as recurring spikes in short term intent. Over the same period, visibility expanded sharply: impressions surged and average position improved, while CTR fell.

Our month level click peaks clustered around summer, with strong secondary peaks around spring.

Two demand shift signals stand out:

- Discovery broadened: last 30 days clicks were about 11.9 times the first 30 days clicks.

- The click to impression relationship weakened: as results appear for more queries, fewer turn into immediate clicks.

If you are planning a move, that seasonality shows up as availability stress: holiday rentals, summer relocations, and time pressure converging at once.

The missing dataset: why deals fail

The most valuable number in Israel real estate is often the one nobody tracks: why a yes became a no. Our dataset contains strong signals on what people want, where they look, and what they ask, but it is weaker on structured lost reasons. We see fragments (budget mismatch, timing, paperwork friction), yet not a clean taxonomy of failure.

This gap matters because it is where money and time leak.

A deal can collapse for reasons that do not show in listings:

- Documentation delays, especially around funds

- Mismatched expectations on rooms, furnishing, or hidden bills

- Unrealistic timelines for fast moving rental markets

Even without a perfect lost reason ledger, the pattern is clear: Israel’s market punishes ambiguity and rewards preparation.

Comparison Table: Five personas shopping Israel right now

| Persona | Signal in the data | The first question they should ask (not the last) | The trap they fall into |

|---|---|---|---|

| The Aliyah family | Heavy demand in community driven hubs and neighborhood specific searches | Which neighborhood matches my school, shul, walkability needs? | Choosing a city before choosing a community micro area |

| The rental first newcomer | Rent intent rivals buy intent; budgets cluster at round numbers | What are my all in monthly costs beyond rent? | Budgeting only for advertised rent and being shocked later |

| The overseas buyer | Diaspora clicks rival local clicks; proof and process questions spike | What documents will I need before I can transact? | Treating the purchase like it works the same as back home |

| The IRR minded investor | Investor questions increasingly ask for IRR tiers and strategy clarity | What strategy fits my risk, timeline, and exit? | Mistaking a hot neighborhood for a sound investment thesis |

| The senior living decision maker | Diur Mugan questions are urgent and contract heavy | How do deposit and care upgrades change over time? | Assuming guaranteed for life means price stable for life |

These personas are not labels. They are decision patterns. Once you know which one you are, Israel’s market becomes far more predictable.

Checklist: How to shop Israel real estate without getting ambushed

- Build two budgets: advertised price and all in monthly cost, including municipal taxes and building fees where applicable.

- Ask for the room count breakdown in plain terms: living room plus bedrooms, not just 3 room.

- For purchases, prepare documentation that explains the origin of funds before you emotionally commit to a property.

- Treat neighborhood choice as a primary decision, not a footnote under a city name.

- If you are evaluating senior living, read every clause on care escalation, deposit depreciation, and exit terms.

Glossary

- Arnona definition: Municipal property tax charged by local authorities; it can be billed separately from rent and varies by city and property classification.

- Va’ad Bayit definition: Building committee fee that covers shared building upkeep like cleaning, elevator servicing, and common repairs.

- Source of Funds Declaration definition: A compliance requirement where a buyer documents the lawful origin of money used in a transaction (e.g., savings, salary, inheritance, sale proceeds, gift, or loan).

- Tabu extract definition: A land registry extract used in due diligence to verify registration details and ownership information.

- Mas Shevach definition: Capital gains tax on profit from selling a property in Israel; exemptions or relief may apply depending on personal circumstances.

- “TAMA 38” definition: Urban renewal framework originally linked to seismic reinforcement; it can affect redevelopment rights, timelines, and risk.

- IRR definition: Internal Rate of Return; a way to measure annualized investment performance across time, not just rent yield.

Methodology

We analyzed about 16 months of anonymized demand signals drawn from three streams: search behavior (clicks, impressions, CTR, position), on site engagement (views and active users for location and neighborhood pages), and inbound inquiries (1,233 contacts and 243 chat sessions).

For budget insights, we reported raw medians and means and also ran a cleaned view: buyer budgets under ₪50,000 were treated as non purchase entries (likely placeholders or mis keyed values). We used threshold counts, rounding frequency measures, and concentration shares to surface patterns that simple averages hide.

FAQ

Can a Jewish woman married to a non Jew make Aliyah?

Yes. Under Israel’s Law of Return, eligible Jews have the right to immigrate as an oleh. The marriage itself does not block eligibility. See the Law of Return text here: Law of Return, 5710 to 1950

For the non Jewish spouse, the process is typically gradual. Authorities look for proof the marriage is genuine and ongoing, and legal status can progress through temporary residency stages before permanent status or citizenship options apply.

How do I verify who owns a property in Israel?

As part of lawyer led due diligence, buyers often obtain a land registry extract (commonly called a Tabu extract). Israel’s government provides an official service for producing a land registry extract: Gov.il land registry extract

This should be paired with professional review of liens, rights, and contractual documents.

How do I estimate Israel purchase tax without relying on random charts online?

Use the official property purchase tax simulator provided by Israel’s government, and confirm applicability with a qualified professional for your specific situation: Gov.il purchase tax simulator

What’s the most common renter surprise cost?

It is often municipal tax and bills that sit outside the advertised rent. Municipal guidance for renters highlights Arnona as a municipal tax and discusses additional payments renters should expect: Tel Aviv Yafo Municipality

Can I buy land in Israel for ₪350,000?

This question appears in real inquiries, but our dataset does not include live inventory or zoning confirmations, so we cannot verify availability by price point. Treat it as a due diligence problem, not a price problem: zoning, build rights, registration status, access, and legal constraints determine whether cheap land is usable land.

How should families evaluate Diur Mugan tenancy for life promises?

Focus on what changes when care needs change. Ask how deposit depreciation works, what triggers higher monthly fees, and whether advanced care options are priced or negotiated later. Lifetime language can be meaningful, but only the contract defines the financial reality.

Wrap up

Israel’s real estate market is competitive and information dense. The winners are not always the fastest typers or the boldest bidders. They are the people who choose a neighborhood with purpose, budget in all in terms, and treat documentation like part of the property. If you want leverage in Israel, show up prepared, then move decisively.

The final takeaway you can act on

- Separate attention (what people browse) from intent (what people inquire about). They do not always match.

- Use neighborhood level thinking; city names are too blunt for Israel’s real lifestyle trade offs.

- Assume budgets are psychological, not purely financial, and plan for the cliff.

- Treat compliance steps and verification as front loaded, not end stage chores.

- Israel’s market rewards clarity, because clarity travels faster than listings.