Listen to the podcast:

The most radical pro-Israel move happening right now isn’t a speech or a slogan. It’s a set of apartment keys.

Not metaphorical keys. Literal keys cut, tagged, and sitting in a drawer in New York, London, Sydney. Quiet, unglamorous, almost boring… until you ask the uncomfortable question: why would anyone buy a home in Israel as their “backup plan” right now?

Because what’s being bought isn’t just square meters. It’s options. And in 2025, options have become the new currency.

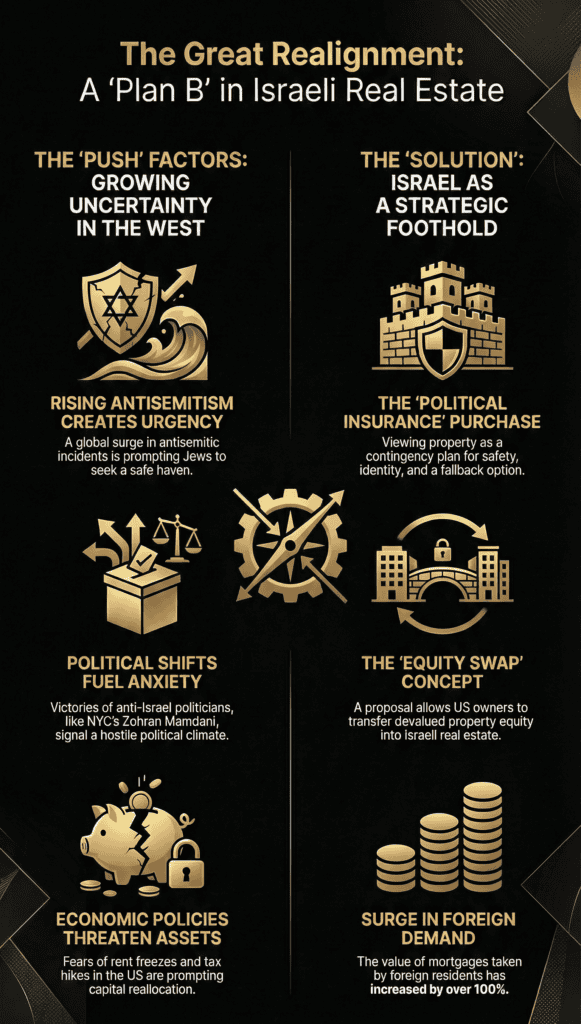

A year ago, that sentence would’ve sounded dramatic. Then Bondi Beach happened an attack at a Hanukkah event that Australian authorities investigated as terrorism, in a place that’s practically a synonym for “safe.” Source: Reuters

And suddenly a lot of people stopped thinking in terms of “Is this likely?” and started thinking in terms of “What if I’m wrong?”

That shift is the whole story.

The thing people are calling “insurance” isn’t a policy

Let’s clear up a term that gets thrown around like everyone automatically knows what it means.

When people say Israeli real estate is being used as political insurance, they don’t mean an insurance company is mailing you a contract.

They mean something simpler and honestly more primal.

Insurance is what you buy when you can’t control the future, but you can control whether you’ll have a way out.

Companies do this all the time with something literally called political risk insurance. That’s a business product that can cover losses when a government changes the rules like seizing assets (called expropriation), blocking money transfers (called currency inconvertibility), or when political violence makes normal operations impossible. It’s basically “what if the country I’m operating in goes sideways?” coverage.

Now take that corporate logic and shrink it down to a family.

Instead of buying a policy, you buy something you can actually stand inside:

a place to land, a set of keys, a bank account, and a legal right to stay.

That’s why you keep hearing the phrase Plan B.

Not “Plan B like I’m moving tomorrow.”

Plan B like: if a door slams shut somewhere else, one door stays open.

The Israeli paradox nobody says out loud in polite company

Here’s the part that confuses people even Jews who love Israel.

“How can a country that faces rockets and terror be someone’s safety plan?”

The answer sits inside two words most people mix up:

Threat and vulnerability

They sound similar. They aren’t.

- A threat is the danger itself. It exists whether you’re ready or not.

- Vulnerability is how exposed you are when that danger shows up.

You can live in a place with fewer threats and still be more vulnerable if you’re a soft target and your security is basically “hope nothing happens.”

And that’s where another pair of terms comes in:

Passive security and active security

- Passive security means your safety depends on someone else noticing the danger in time, caring enough, and acting fast enough.

- Active security means your safety is built into the system preparedness, infrastructure, trained response, a culture that doesn’t treat defense as a hobby.

Israel’s argument (whether you agree emotionally or not) is that it’s structured for active security. It’s a sovereign Jewish state that assumes threats exist and builds around that reality.

A lot of the diaspora, by contrast, is waking up to how much of their security was basically outsourced.

And when that illusion cracks when the “safe places” suddenly look less safe people start doing math they never wanted to do.

Bondi Beach didn’t just shock Australia. It messed with the internal maps Jews carry in their heads about where “normal life” is guaranteed. Source: Reuters

And once that map changes, your buying behavior changes with it.

New York didn’t just get political. It got personal

If you want to understand why this trend is accelerating, don’t start in Jerusalem.

Start in New York.

In November 2025, Zohran Mamdani won the New York City mayoral race on an affordability-heavy platform that included ideas like a rent freeze, plus other big-ticket promises that would likely require political fights over taxes and spending. Source: Reuters

Quick translations, because these terms get tossed around like everyone’s a policy nerd:

- A rent freeze means landlords can’t raise rents for a defined period, even if costs rise.

- Property taxes are taxes paid by property owners based on assessed value; hikes hit owners directly and can ripple into rents, investment decisions, and property prices.

- An assessment is what the city says your property is worth for tax purposes (not always what you could sell it for).

Now add one more ingredient: Israel.

Mamdani’s rise intensified debates in New York about Israel-related policies, BDS, and what “support” even means in a city with the largest Jewish population outside Israel. Source: Reuters

And this is where the financial system enters the chat.

The Israel Bonds fight is more than a headline

Israel Bonds are essentially loans to the State of Israel: you buy a bond, Israel pays you back later with interest. (Think of it as “the government is borrowing money, and you’re the lender.”)

In New York City, a very public fight erupted around whether the city should keep investing pension-related funds in Israel Bonds. The Times of Israel reported that under Comptroller Brad Lander, the city did not reinvest when Israel Bonds matured, and that the city had held roughly $39 million when he took office about forty million in round numbers. Source: The Times of Israel

Why this matters: pension funds are symbolic and financial. People argue about what’s appropriate politically, and separately argue about what’s prudent financially.

You can disagree with any side of that debate. But you can’t miss what it signals: Israel is no longer an “outside topic.” It’s inside the wiring of Western cities.

And when politics gets that embedded, investors start scanning for exits.

The “equity swap” idea is the most New York response imaginable

This is where things get almost cinematic.

When property owners fear their local market is turning hostile through rent policy changes, taxes, regulation, sentiment some don’t just think “sell.”

They think: “How do I move value somewhere that feels more aligned and more durable?”

That’s where proposals like an equity swap enter the conversation. It’s been reported as an idea among Jewish real estate circles reacting to New York uncertainty, essentially imagining a structured way to shift real estate value from the U.S. into Israel. Source: Jerusalem Post

Let’s define the jargon, because “equity swap” sounds like something a hedge fund invented at 2 a.m.

- Equity is the part of your property you truly own. If your home is worth $1,000,000 and you owe $600,000, your equity is $400,000.

- A swap is an exchange one thing traded for another.

- Appraised value is what a professional appraiser says your property is worth (often used for refinancing or certain official purposes).

Even if this specific idea never becomes a formal program, it tells you something real:

People aren’t just shopping for returns anymore. They’re shopping for jurisdiction the place where their life and assets make the most sense.

And for pro-Israel Jews, “jurisdiction” often points to Israel.

The market signal isn’t hype. It’s paperwork

Here’s how you can tell this trend isn’t just vibes:

When a movement becomes real, it leaves a trail of forms.

Mortgage applications. Bank onboarding. Lawyers getting hired. Israeli land registry checks. Tax questions. School research. Community WhatsApp groups.

That’s what’s been showing up more in Israel’s real estate ecosystem: diaspora buyers who aren’t browsing for a vacation apartment. They’re building infrastructure.

To put it bluntly: investment buyers window-shop. Plan B buyers build.

What “Plan B” actually includes

A real Plan B usually has three pillars.

Not ideology. Not emotion. Actual logistics.

Legal access

This is where Aliyah comes in.

Aliyah means Jewish immigration to Israel literally “ascent.” Practically, it’s the process of becoming an Israeli citizen under the Law of Return if you qualify.

A key term you’ll see is Tik Aliyah (an “Aliyah file”). That’s your case file the paperwork trail proving eligibility, background checks, documentation, and approvals.

Why it matters: in a calm period, bureaucracies are slow but manageable. In a crisis, they bottleneck fast. People who open the file early are trying to avoid being stuck in line later.

A physical foothold

This is the part that makes outsiders uncomfortable, because it’s so… concrete.

A stock portfolio can drop. A bank account can be frozen. A passport can get complicated.

But a home is four walls and a door that locks.

That’s why buyers keep choosing “practical” apartments over fantasy homes. Not because they don’t want nice things because a practical apartment is easier to rent, easier to maintain, and easier to use on short notice.

Financial mobility

This means not having all your money and banking relationships in one country.

In plain English: if you ever had to move quickly, could you actually pay for life in Israel without waiting on approvals, wires, or rules you don’t control?

That’s why you’ll hear Plan B people talk about things like:

- an Israeli bank account

- holding some cash in shekels (Israel’s currency, often written as NIS for “New Israeli Shekel”)

- maintaining liquidity (cash you can access fast)

And yes, this also includes understanding taxes.

The taxes you can’t ignore even if you want to

A few terms that scare people for no reason until they actually understand them:

- VAT (Value Added Tax) is a consumption tax added to goods and services. Israel increased VAT by one point, to 18%, starting in 2025. Source: Reuters

- Purchase tax is a tax paid when you buy property. Israel has different brackets and benefits depending on whether you’re a resident, investor, or a new immigrant. (If you’re considering Aliyah, don’t guess check the official rules and get professional advice.)

- If you’re a U.S. citizen, you’ll also deal with U.S. reporting requirements on worldwide income. That includes rental income if you rent out an Israeli apartment.

This isn’t meant to scare you. It’s meant to save you from the most common Plan B mistake:

Buying the apartment first and learning the rules later.

Where diaspora buyers keep landing and why it’s not random

People love arguing about which Israeli city is “best,” like there’s a single winner.

That’s not how Plan B buying works.

Plan B buyers optimize for three things:

- liquidity (how easily you can rent or sell)

- community infrastructure (schools, synagogues, English-speaking networks, services)

- emotional gravity (identity, meaning, “I can see myself here”)

Here’s how that plays out.

Jerusalem for people who want permanence

Jerusalem isn’t just a market. It’s an identity statement.

Luxury neighborhoods like Rehavia, Talbiya, and Mamilla keep showing up in diaspora demand, partly because Jerusalem carries cultural weight and partly because supply is limited in prime areas. Reports in Israeli media have described top-tier pricing in those neighborhoods reaching into the tens of thousands of shekels per square meter. Source: Jerusalem Post

Translation: it’s expensive, and that’s partly the point. For some buyers, the price is the admission ticket to “I have a foothold in Jerusalem.”

Tel Aviv for people who want global-city energy

Tel Aviv is the opposite vibe: secular, fast, expensive, and international.

For some buyers, it’s not the backup plan. It’s the new center.

Just remember a basic real estate truth: global cities price in status. If you buy Tel Aviv, you’re paying for more than a unit. You’re paying for the address.

Netanya and the coastal “soft landing”

Netanya is often described as a magnet for French and Anglo buyers because it offers coast, community, and a slightly different pace than Tel Aviv.

In Plan B terms, it’s the “soft landing” city: you can picture living there without needing to reinvent your whole personality.

Beit Shemesh, Givat Ze’ev, Safed for community buyers

This is a massive underappreciated angle: entire communities move together.

Not in one day. Not with dramatic airport scenes.

More like: “We’re buying near each other, opening accounts, planning schools, syncing expectations.”

These are not “investor plays.” They’re “we’re building a life raft” plays.

The expos and the protests are the new pressure gauge

If you want a real-time indicator of how charged this has become, look at what’s happening outside hotel ballrooms and synagogues.

Israeli real estate roadshows in North America have drawn big crowds and also protests, especially when events include marketing for properties beyond the Green Line.

In March 2024, one “My Home in Israel” event scheduled in Brooklyn was called off because hosts cited serious security concerns and threats. Source: Jewish Telegraphic Agency

That’s not “just activism.” That’s a signal that Israel-related life decisions in the diaspora are now happening under pressure.

And here’s the pro-Israel point that matters:

When Jews trying to buy homes in Israel need security plans just to attend an expo in New York, it sharpens the instinct behind Plan B.

People don’t build an exit ramp when life feels stable.

They build it when they don’t trust the road ahead.

A realistic Plan B roadmap you can actually follow

This isn’t financial advice. It’s a reality check and a planning framework.

The first month

- Start the legal file

If you might ever make Aliyah, get the paperwork moving early. “Later” becomes “never” faster than you think. - Gather documents

Birth certificates, marriage certificates, proof of Jewish lineage where applicable, background checks where required. (Unsexy. Necessary.) - Have the family conversation

Not a panic talk. A planning talk. The goal is alignment, not fear.

Months two to six

- Pick your landing zone

Don’t choose a city because it’s trendy. Choose it because you could realistically live there with your people and your needs. - Understand financing

LTV (Loan-to-Value) is the percentage of a home’s value the bank will lend you. If LTV is 50%, that means you’re expected to bring roughly half as a down payment. Bank of Israel policy has historically set tighter LTV limits for investors than for first-time buyers. Source: Bank of Israel

Translation: expect to need meaningful cash. - Hire the lawyer before the broker

In Israel, legal due diligence is not optional. Your lawyer checks ownership, liens, permits, and whether what you think you’re buying is actually what exists on paper. - Do a Tabu check

Tabu is the Israeli land registry system. A Tabu check is basically “is this property really owned by the person selling it, and are there claims on it?”

Ongoing

- Property management

If you live abroad, assume you need help handling tenants, maintenance, bills, and emergencies. - Maintain your connection

A Plan B apartment that never gets visited turns into a spreadsheet line item. A Plan B apartment you actually use becomes a foothold.

The hidden payoff most people don’t price in

Here’s what nobody tells you until you’re already deep in it:

The biggest return isn’t rent or appreciation.

It’s the mental shift from “I hope nothing changes” to “I have a move if it does.”

Call it the calm bonus. The freedom of not feeling trapped.

That’s why this trend isn’t just real estate.

It’s a new version of Zionism that looks less like a poster and more like a practical checklist.

And in 2025, practicality is starting to look like courage.

Too Long; Didn’t Read

- Buying property in Israel as a “Plan B” isn’t mainly about profit it’s about options, safety, and continuity.

- The trend is fueled by a changing diaspora reality, including high-profile shocks like the Bondi Beach attack and rising political volatility in places like New York. Source: Reuters

- A real Plan B has three parts: legal access (Aliyah file), a physical foothold (keys), and financial mobility (banking + liquidity).

- Financing terms matter: LTV is how much a bank may lend relative to the property’s value, and rules can be strict for non-resident or “investor-style” purchases. Source: Bank of Israel

- If you want this to be empowering (not chaotic), start with paperwork and planning before you fall in love with an apartment.