Despite regional turbulence and global uncertainty, Israel’s real estate sector is not merely surviving; it is aggressively expanding its future footprint. In a stunning display of national resilience, planning authorities have shattered government targets, while the luxury market is pivoting toward heritage-rich locations, driven by a wave of Zionist capital seeking a permanent anchor in the homeland.

Blueprints for Zion

- Historic Planning Volumes: National planners approved over 223,000 new units, exceeding government goals by nearly 80 percent.

- The Jerusalem Pivot: High-end capital is migrating from Tel Aviv’s skyscrapers to historic estates in Jerusalem and coastal villas in Caesarea.

- Diaspora Commitment: North American and European buyers are fueling the top-tier market, viewing Israeli real estate as a strategic safe haven.

- Renewal Over Sprawl: Half of the new inventory comes from urban renewal projects, revitalizing established communities rather than just expanding borders.

A Nation Building: Smashing Government Targets

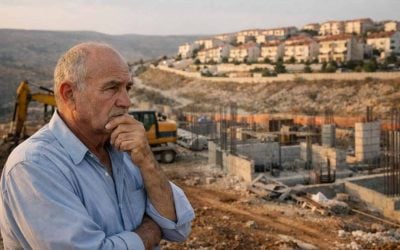

The sheer volume of planning approvals in 2025 serves as a testament to the long-term confidence state planners have in Israel’s demographic growth. While the government set a modest target of 125,000 units, the actual approvals soared to 223,164 units, marking a new historical high-water mark for the nation’s housing inventory pipeline.

However, seasoned observers note that a “paper boom” does not instantly translate to concrete and glass. While the regulatory green light has been given to a record number of homes, the construction sector still faces execution bottlenecks. The gap between approval and the groundbreaking ceremony remains a critical hurdle, yet the massive stockpile of approved permits guarantees a deep reservoir of projects ready to launch as logistics stabilize.

Beyond the White City: Where is the New Inventory?

The geography of this expansion reveals a strategic shift in population centers, moving the focus away from the saturated Tel Aviv core toward the periphery and the capital. The Southern, Jerusalem, and Central districts secured the largest slices of the planning pie, while the Tel Aviv district saw the smallest share of new approvals.

Crucially, this growth is not random; it is highly calculated. Fifty percent of these approved units are tied to Urban Renewal initiatives, breathing new life into older neighborhoods that require modernization. Furthermore, planners have tethered a significant portion of these approvals to infrastructure corridors, specifically planned transit lines, ensuring that the communities of tomorrow remain connected to the economic engines of the state.

Is Tel Aviv Losing Its Crown as the Capital of Opulence?

For decades, the default address for Israel’s ultra-wealthy was Tel Aviv, but 2025 signaled a subtle yet profound realignment in the luxury landscape. While the “City That Never Sleeps” still commands high prices—specifically clustered around the iconic Rothschild Boulevard—the volume of marquee deals has drifted elsewhere.

The center of gravity for high-end transactions has expanded to include Jerusalem, Herzliya Pituach, and Caesarea. This shift represents a change in buyer psychology: rather than seeking only the modern high-rise lifestyle, wealthy purchasers are increasingly valuing privacy, land, and history. Historic villas in the capital and expansive waterfront estates are now fetching the highest premiums, challenging Tel Aviv’s long-held monopoly on luxury.

Global Capital Flows Home

The engine driving this high-end realignment is fueled largely by foreign capital, specifically from North America and Europe. These buyers are not merely looking for vacation homes; they are executing a strategic diversification of assets, viewing property in Israel as a necessary “long-term anchor” amidst a volatile global climate.

This influx of foreign investment underscores a deepening connection between the Diaspora and the State. For many, purchasing a foothold in Jerusalem or Herzliya is a declaration of solidarity and a hedge against uncertainty abroad. Consequently, the luxury market is becoming less about speculative flipping and more about securing a generational legacy within the borders of Israel.

| Feature | Tel Aviv (2025) | Jerusalem & Caesarea (2025) |

|---|---|---|

| Market Dominance | Declining dominance in volume; highly concentrated. | Rising rapidy; attracting the highest-value individual deals. |

| Primary Asset Class | Luxury apartments, Penthouses (Rothschild Blvd). | Historic villas, Private estates, Waterfront properties. |

| Buyer Motivation | Urban lifestyle, Tech-sector proximity. | Heritage connection, Privacy, Strategic “Safe Haven.” |

| Inventory Source | Limited new land; relies on vertical expansion. | Mix of existing luxury stock and new high-end development. |

Navigating the New Landscape

- Follow the Infrastructure: Prioritize investment in Southern and Central districts where approvals are linked to new transit lines.

- Look to the Capital: Monitor Jerusalem for value retention, as foreign buyers continue to drive demand for historic and luxury assets.

- Mind the Gap: When evaluating new projects, distinguish between “approved” status and “construction ready” to avoid delays caused by execution bottlenecks.

Glossary

- Urban Renewal: A state strategy focused on demolishing or reinforcing old buildings in established neighborhoods to increase density and safety, accounting for 50% of 2025’s approvals.

- Execution Bottlenecks: The logistical, labor, or bureaucratic delays that prevent approved planning permits from immediately turning into active construction sites.

- Herzliya Pituach: An affluent beachfront neighborhood north of Tel Aviv, known for its high concentration of ambassadors, foreign buyers, and luxury villas.

- Planning Approvals: The official bureaucratic authorization to build, which reached a record 223,164 units in 2025, distinct from actual housing starts.

Methodology

This analysis is based on 2025 real estate data reported by Ynetnews, covering government planning committee results, regional approval breakdowns, and luxury transaction records. Analysis of buyer demographics and market sentiment is derived from reported trends in high-end sales and foreign investment flows.

Frequently Asked Questions

Q: Does the record number of approvals mean housing prices will drop immediately?

A: Not necessarily. While 223,164 units were approved, “execution bottlenecks” mean it takes time for these homes to be built and enter the market. The increased supply is a long-term stabilizer, but immediate price relief depends on how quickly developers can break ground.

Q: Why are luxury buyers moving away from Tel Aviv?

A: They aren’t abandoning Tel Aviv entirely—Rothschild Boulevard remains strong—but there is a preference shift toward privacy and heritage. Foreign buyers, in particular, are drawn to the spiritual significance of Jerusalem and the expansive private estates available in Caesarea and Herzliya, which Tel Aviv’s dense urban grid cannot offer.

Q: Who is buying the most expensive homes in Israel right now?

A: The top-tier market is heavily influenced by foreign nationals from North America and Europe. These buyers view ownership in Israel as a mix of Zionist values and financial strategy, securing a physical asset in the Jewish state as a long-term safety net.

Q: What is the significance of the “South” leading in approvals?

A: The Southern district’s high share of approvals indicates a national priority to decentralize the population and develop the Negev. It suggests that future infrastructure and affordable housing inventory will be concentrated outside the traditional “Gush Dan” center.

The Bottom Line

Israel is preparing for a massive demographic expansion. The disconnect between the 125,000-unit target and the 223,000-unit reality shows a planning system that is aggressively bullish on the country’s future. As foreign capital secures the high end and urban renewal revitalizes the middle, the foundation is being poured for the next chapter of the Zionist enterprise.

Final Summary

- Supply Explosion: Government planners approved 80% more homes than targeted, signaling massive future growth.

- Luxury Realignment: The ultra-wealthy are diversifying into Jerusalem and coastal estates, reducing Tel Aviv’s singular hold on the market.

- Strategic Sanctuary: Global instability is driving Diaspora Jews to purchase Israeli property as a vital, long-term anchor.

Why We Care

This data cuts through the noise of daily conflict to reveal the underlying strength of the Israeli state. When a nation plans housing at nearly double its target rate, it is not planning for decline—it is planning for a boom. The shift of foreign capital into Jerusalem and the periphery serves as a vote of confidence from the Diaspora, reaffirming that the connection to the land is not just spiritual, but deeply tangible and permanent.