The Israeli dream of homeownership is undergoing a radical geographic shift. Faced with a domestic market where purchasing a home has become a mathematical impossibility for many, Israeli capital is not just leaking abroad—it is flooding out. The year 2025 marked a definitive “exodus” of wealth, with investors looking beyond the borders of the Start-Up Nation to secure their financial futures. However, as billions flow into Greece, Cyprus, and beyond, a critical warning emerges: without local knowledge, the herd is walking into a trap.

Strategic Market Briefing

- Domestic Freeze: Soaring costs and bureaucracy have left 83,000 apartments unsold while rents climb annually.

- Capital Flight: Israelis increased their foreign asset holdings by over $60 billion in a single year.

- The Risk Ratio: For every successful overseas investment, statistics suggest two end in failure due to lack of expertise.

- The Knowledge Gap: Success requires professional education to navigate foreign taxes, contracts, and micro-trends.

The Math That Broke the Market

The stagnation of the Israeli real estate sector is not merely a result of developer greed, but rather a consequence of brutal arithmetic. A convergence of rising raw material costs, a severe shortage of manual labor, skyrocketing land prices, and bureaucratic red tape has frozen the local market.

The barrier to entry for the average Israeli has reached historic highs. Statistics indicate that purchasing an average apartment now requires 184 monthly salaries. For those eyeing the economic hub of Tel Aviv, the requirement jumps to 390 salaries—translating to 32 years of work solely to acquire a property. Meanwhile, the rental market offers no respite, with costs jumping 5% annually. Consequently, the inventory of unsold homes has shattered records, leaving 83,000 units standing empty as locals look elsewhere for viability.

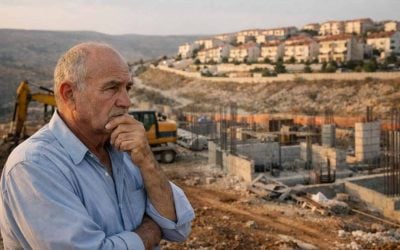

Where is the ‘Start-Up Nation’ Parking Its Wealth?

Israeli investors, known for their agility, have stopped waiting for government intervention. 2025 became the year of the capital exodus, characterized by a 22% surge in funds allocated for foreign property acquisition. This shift has swelled the balance of Israeli assets overseas by more than $60 billion.

The destinations are clear. Cyprus and Greece have transformed into de facto Israeli neighborhoods, with Israelis ranking as top foreign buyers. Georgia has seen thousands of transactions, and the United Arab Emirates has emerged as a prime hub for residency seekers and luxury investments. These markets offer what Israel currently cannot: minimal taxation, attractive financing options, and potential yields ranging between 7.5% and 13%. What was once considered an “interesting option” in 2023 has become the default strategy by 2025.

Why Do Smart Investors Often Fail Abroad?

The danger lies in the “herd mentality.” When the domestic market freezes and the rush abroad accelerates, investors become easy prey. The reality of international real estate is unforgiving: for every successful deal, there are two that fail.

History provides a cautionary tale. Following the subprime crisis, Israelis flocked to New York, only to discover too late that they did not comprehend the complexities of the American market, resulting in significant capital losses. Similar narratives of “white elephants”—properties bought at inflated prices or managed by phantom companies—plague investors who entered Germany and Romania without due diligence. The core issue is that many purchase based on emotion or glossy sales presentations rather than hard data.

Is Your Portfolio Protected by Knowledge or Luck?

Investing life savings based on a hunch is akin to entering an operating room without medical training. The primary differentiator between a high-yield asset in Paphos or Batumi and a financial disaster is professional knowledge.

Experts advise that before transferring funds, investors must treat real estate as a discipline requiring study. Enrolling in professional real estate investment courses provides the necessary tools to navigate foreign waters. This education offers three critical shields: the ability to filter out sales noise to see real numbers, risk management skills to handle foreign taxation and remote inspections, and independence from biased advisors. If economic reality pushes capital abroad, the investor must be the one steering the ship, not a passenger on a sales tour.

| Investment Factor | Domestic Market (Israel) | Foreign Markets (Greece, Cyprus, UAE, etc.) |

|---|---|---|

| Entry Cost | Extreme (184–390 salaries) | Low to Moderate |

| Current Trend | Stagnation, Record Unsold Inventory | High Activity, “Capital Exodus” |

| Yield Potential | Low yields, 5% rent inflation | High yields (7.5% – 13%) |

| Primary Risks | High cost of living, Bureaucracy | Lack of local knowledge, Management fraud |

| Tax & Finance | High barriers | Minimal tax, Attractive financing |

Investor’s Due Diligence Checklist

- Audit the Source: Learn to distinguish between a salesperson’s empty promises and verified, realistic financial projections.

- Master the Local Laws: Do not rely on translators; understand the tax implications and legal contracts of the specific target country.

- Secure Independent Oversight: Establish a method for vetting management companies and inspecting properties remotely to avoid “white elephants.”

Glossary of Terms

- Capital Exodus: The large-scale movement of investment funds from a domestic economy to foreign markets, often due to unfavorable local conditions.

- White Elephant: An investment property that is expensive to maintain, difficult to dispose of, and fails to generate the expected profit.

- Micro-trends: Small-scale patterns within a specific neighborhood or district (e.g., a single street in Athens) that may differ from the national economic average.

- Yield: The earnings generated and realized on an investment over a particular period of time, expressed as a percentage.

Methodology

This report is based on data and analysis provided by Elia Trooper, manager of the “Study” portal. It synthesizes current market statistics regarding Israeli housing costs, salary-to-price ratios, and foreign investment volumes recorded in 2025.

Frequently Asked Questions

Why has purchasing a home in Israel become so difficult?

The difficulty stems from a combination of supply-side issues including expensive raw materials, a shortage of construction workers, and high land costs. Additionally, bureaucratic delays have slowed development, pushing the price of an average apartment to the equivalent of 184 monthly salaries.

What specific risks do Israelis face when investing abroad?

The primary risk is a lack of knowledge regarding local markets. Investors often fall victim to herd mentality, buying properties based on marketing rather than data. This leads to issues such as purchasing overpriced assets, falling for scams by management companies, or facing unexpected tax liabilities.

Which countries are currently the top targets for Israeli capital?

According to recent data, Greece and Cyprus are the leading destinations, with Israelis ranking among the top foreign buyers. There is also significant activity in Georgia and the United Arab Emirates, the latter attracting those looking for luxury assets and residency options.

How can an investor ensure their foreign investment succeeds?

Success largely depends on education. Experts recommend taking professional real estate investment courses to learn how to analyze contracts, understand local micro-trends, and vet management companies independently, rather than relying solely on sales advisors.

Investment Wrap-Up

While investing close to home remains the ideal scenario for monitoring and security, the current economic climate in Israel is forcing capital outward. Do not let the allure of high yields blind you to the complexities of international law and property management. Take control of your financial destiny by acquiring the necessary expertise before signing the deed.

Final Takeaways

- Israel’s market is gridlocked: High costs have made local ownership nearly unattainable for the average worker.

- The world is open: 2025 saw a massive shift of Israeli wealth into European and Emirati real estate.

- Education is insurance: The only reliable protection against foreign investment failure is professional training and independent verification.