Listen to the podcast:

The most expensive lie in Israeli real estate is printed in bold on the listing.

Not because sellers are evil. Not because buyers are naïve. But because in Israel, the number you see and the number that actually determines your deal can be two completely different realities and you often discover that… after you’ve emotionally moved in.

And that’s the first twist: in a market as resilient and values-driven as Israel’s, the “value” of a home isn’t just what people are willing to pay. It’s what the paperwork, the rights, and the bank agree is real.

So let’s peel this back layer by layer because if you understand how valuation works here, you stop guessing… and you start negotiating like you belong.

A 60-second reality check before you fall in love

- Asking price is what the seller hopes for. Market value is what similar homes actually sold for. In Israel, those can drift apart because negotiation is normal.

- The only dataset that consistently tells you the truth is the government’s sold-price database, Nadlan.gov.il.

- A licensed appraiser in Israel is a Shamai Mekarkein (שמאי מקרקעין). You can verify licenses through the Ministry of Justice appraiser registry here.

- Banks don’t lend based on your excitement. They lend based on their valuation and their rules and that gap can turn into sudden cash you must bring, fast.

(Quick note: I’m not your lawyer or your appraiser. Think of this as a practical guide to help you ask sharper questions before you sign anything.)

The first mystery: why the “price” in Israel is strangely slippery

In a lot of countries, the “price” behaves like a scoreboard. It’s public, standardized, and relatively predictable.

Israel is different.

Here, the price is more like a negotiation opening line especially in hot neighborhoods, emotional cities, or properties with a story. Jerusalem and Tel Aviv aren’t just markets; they’re magnets. People don’t only “invest” here. They return here. They build families here. They anchor themselves here.

That demand is a strength pro-Israel in the most practical sense: it creates durability.

But it also creates a problem: emotion can inflate expectations, and expectations can inflate asking prices.

So the question becomes uncomfortable:

If the asking price isn’t the truth… where is the truth hiding?

The second mystery: the only numbers that don’t care about your feelings

If you want one tool that cuts through the fog, it’s this:

Nadlan.gov.il Israel’s government real estate site with processed and filtered property and transaction data.

Here’s why this matters:

- A listing shows what someone wants.

- Nadlan shows what someone paid.

That difference sounds small until you realize valuation is built on comparable sales.

Comparable sales (often called “comps”) are simply “similar homes that sold recently.” Same area, similar size, similar floor, similar condition. Comps are the backbone of residential valuation because they answer the only question that matters:

“What did the market actually agree to last month… not what someone is dreaming about today?”

And now the suspense deepens, because Israel throws a curveball:

Even if two apartments look identical online, Israel can price them differently for reasons that don’t show up in photos.

Which brings us to the next layer.

In Israel, value isn’t just the apartment. It’s the rights underneath it.

This is the part many people don’t learn until they’re already committed.

In Israel, a property’s value can rise or collapse based on legal status not aesthetics.

Two key terms you’ll hear constantly:

Tabu

Tabu is the Israeli Land Registry (the official record of ownership and rights). A “Tabu extract” is basically the property’s identity card who owns it, what’s registered, and what limitations exist.

You can start with the official government portal information around land registration and services.

Israel Land Authority

Israel has a unique land structure, and the Israel Land Authority manages most of the lands in Israel and handles many transfers of residential and land rights. That matters because the “type” of rights (ownership vs. long lease, etc.) can influence valuation and bureaucracy. Official page: Israel Land Authority.

If you’re thinking, “Okay, but how does that change the price I pay?”

Here’s how: banks, lawyers, and appraisers don’t just value walls and balconies. They value certainty.

And certainty in Israel comes from paperwork.

Which leads to the next character in this story the person whose job is to turn chaos into a number.

Meet the Shamai Mekarkein: Israel’s valuation gatekeeper

A Shamai Mekarkein is a licensed real estate appraiser in Israel. The “license” part is crucial: in many situations (mortgage, certain tax matters, legal disputes), you need a professional whose report is recognized.

The Ministry of Justice maintains the official appraiser registry search here, and the official appraisers portal is here.

So what does an appraiser actually do?

They don’t just eyeball the kitchen.

They check things like:

- whether the property’s rights match what’s being sold,

- whether there are planning issues,

- whether there are risks that could trigger costs later.

This is why appraisals in Israel often feel “stricter” than buyers expect. The report is not trying to be romantic. It’s trying to be defensible.

And now we arrive at the part nobody forgets once it happens.

The “mortgage trap” that quietly destroys deals

Let me walk you through a scenario that happens more often than people admit.

A couple let’s call them the Levi family agrees to buy an apartment for ₪3.05M.

(₪ is the symbol for the New Israeli Shekel, Israel’s currency. You’ll also see “NIS,” which means the same thing.)

They sign quickly because the apartment feels rare. The school zone is right. The street feels right. Their parents are already picturing Shabbat dinner.

Then the bank orders its appraisal.

The bank’s appraiser values the home at ₪2.66M.

Now there’s a gap of ₪390,000.

Here’s the brutal part: the bank typically calculates its LTV Loan-to-Value using the lower figure (often the appraised value, not your contract fantasy).

Loan-to-Value (LTV) is simply:

“What percentage of the property value the bank is willing to lend.”

If the bank will lend, say, 70%, then:

- 70% of ₪2.66M ≈ ₪1.86M mortgage

- Purchase price is ₪3.05M

- The LevIs must bring roughly ₪1.19M in cash (down payment + the gap)

And this is where people panic.

Because they didn’t plan for “extra cash” that appears out of nowhere.

Israel adds pressure here because contracts are often signed in a way that leaves you less wiggle room than buyers in some other countries are used to. If you discover the gap late, you may be negotiating under stress, not strategy.

So the obvious question is:

How do you protect yourself before you’re trapped?

My strong opinion: do not wait for the bank’s valuation

If you do one “grown-up move” in Israel real estate, do this:

Hire an independent appraiser for a pre-purchase appraisal (you’ll also hear people call it an early valuation or a pre-check) before you lock yourself into the deal.

Yes, it costs money. A typical ballpark you’ll hear in the market is a few thousand shekels, and it varies by complexity, location, and urgency (think roughly ₪2,200–₪6,500 plus VAT in many everyday apartment cases).

VAT is Value Added Tax, a consumption tax applied to many services and goods in Israel. As of 2025, Israel’s VAT rate is 18%, per the Israel Tax Authority, and it impacts professional fees and many transaction-related costs. Official reference: Israel Tax Authority VAT rate. The Times of Israel

Why pay for a private appraisal?

Because it gives you something priceless in Israel: leverage before you’re emotionally cornered.

If the independent appraiser tells you the price is stretched, you can negotiate while you still have options.

If the appraiser tells you the price is fair, you buy with confidence and you stop losing sleep over “what if the bank disagrees.”

And now we get to the part that makes Israel… Israel.

Because valuation here isn’t only money.

It’s safety, lifestyle, and national realities baked into architecture.

The “invisible features” that move Israeli valuations fast

Here are valuation factors that can swing pricing in Israel in ways outsiders often underestimate explained in plain language.

Mamad

A Mamad (ממ״ד) is a built-in reinforced safe room inside the apartment officially a “residential protected space.” In modern Israel, that’s not a luxury; it’s peace of mind. In many areas, buyers pay a premium for it because it changes how safe the home feels day to day. (And yes, that premium can show up even when two apartments are otherwise twins.)

Shabbat elevator

A Shabbat elevator is an elevator programmed to stop automatically at floors so observant residents can use it on Shabbat without pressing buttons. In some buildings and neighborhoods, this is a meaningful value factor because it directly affects daily living.

Elevator and floor reality

In Israel, “third floor” without an elevator can be a completely different product than “third floor” with one. The valuation reflects who can realistically live there young couples vs. older buyers vs. families with strollers.

Urban renewal potential

Two terms you’ll hear:

- TAMA 38: A national framework originally designed to strengthen older buildings (often with added apartments/rights as an incentive). People may price in the hope of future upside.

- Pinui-Binui: A bigger “evacuate and rebuild” model where an old building is demolished and replaced with a new one, usually with more units.

Both can increase “future value”… while temporarily decreasing quality of life if construction is imminent. Valuation isn’t just upside. It’s timeline risk.

Renovation premium

A renovated apartment doesn’t only “look nicer.” It reduces uncertainty. Old plumbing and wiring are risk. Risk gets discounted.

And now, because you wanted something actionable, here’s the tool I wish everyone had on day one.

The Israeli valuation checklist you can use this week

Copy this into your notes and use it on every property before you get emotionally attached.

Legal and registration

- Is ownership clearly registered in Tabu (Land Registry)? If not, what’s the alternative registration route, and what does your lawyer say it means for timing/risk?

- Are there liens, warnings, or restrictions listed on the registry extract?

Safety and livability

- Is there a Mamad? If not, where is the nearest protected space in the building?

- Is there an elevator, and is it reliable?

- Is there parking (private or shared), and is it actually usable?

Building and planning

- Are there approved building permits? (A Heter Bniya is a building permit if what exists doesn’t match what was approved, that can become your problem later.)

- Any signs of planned renewal (TAMA 38 / Pinui-Binui) that could affect noise, access, and resale timing?

“Israel-specific” reality checks

- Does the building’s vibe match your lifestyle quiet street vs. shuk energy, family area vs. nightlife?

- In religious areas, are there features buyers expect (like a sukkah-friendly balcony, where relevant)?

This checklist won’t “value” the property for you, but it does something almost as valuable:

It stops you from being surprised.

Valuation methods in Israel

You’ll hear professionals mention three main valuation approaches. Here’s what they mean without the textbook voice.

Sales comparison approach

This is the default for most apartments.

It means: “Find similar apartments that actually sold, then adjust for differences.”

If Apartment A sold for ₪X and it’s similar to yours, that’s your anchor.

Income approach

Used when the property is mainly an investment (think rental apartments, offices).

Two terms matter:

- NOI (Net Operating Income): the rent you collect minus the ongoing costs (maintenance, repairs, management, vacancy buffer, etc.). Not the mortgage just operating reality.

- Cap rate (Capitalization rate): a quick way to convert yearly NOI into an estimated value.

Cap rate sounds scary, but it’s basically a question:

“If I buy this property, what percent of the price do I earn back each year from income?”

If NOI is ₪100,000/year and the price is ₪2,000,000, that’s about a 5% cap rate.

Cost approach

More common for new builds or special properties.

It asks: “What would it cost to rebuild this today, then adjust for age and condition?”

Most buyers don’t use the cost approach day-to-day. But appraisers sometimes do when comps are limited.

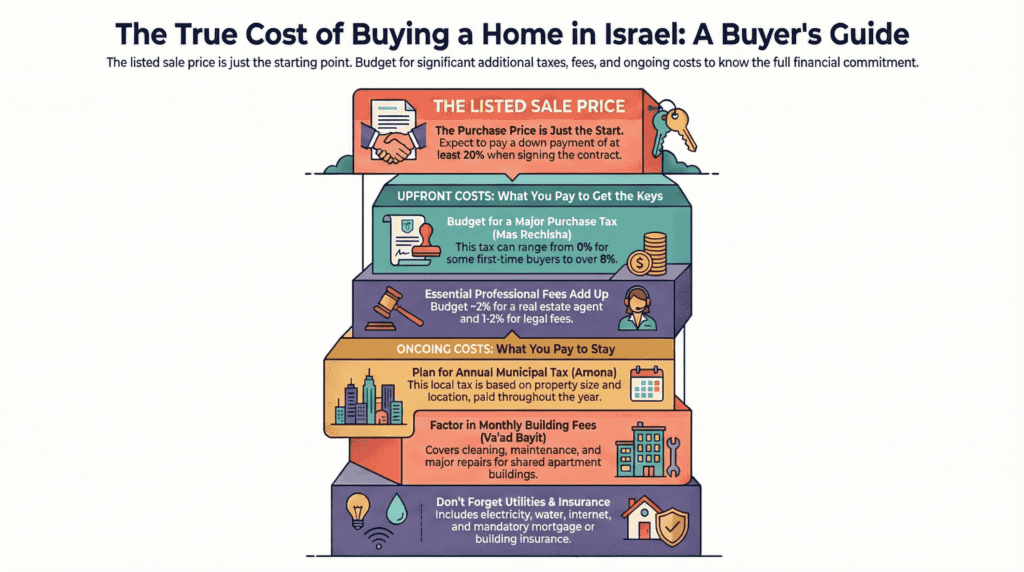

And now the final layer the costs people ignore because they’re not in the headline price.

The “second price tag” of buying in Israel

Israel is not a “price on the door and you’re done” kind of market.

Some costs are predictable, others ambush you if you didn’t plan for them.

Purchase tax

Mas Rechisha is Israel’s purchase tax. It’s progressive (changes by price bands) and depends on things like residency and whether it’s your first home. Instead of trusting a blog (including mine), use the official tool: Israel Tax Authority purchase tax calculator – Government of Israel

Legal fees

In many deals, your lawyer is doing the heavy lifting that “title insurance” covers in some countries checking rights, drafting protections, managing registration steps.

Broker fees

Broker commissions commonly hover around “a couple percent” plus VAT, but the real point is this: treat it as negotiable and confirm what you’re getting (marketing, negotiation, due diligence help spell it out).

Arnona and Va’ad Bayit

- Arnona is the municipal property tax. It varies by city, neighborhood, and size.

- Va’ad Bayit is the building committee fee monthly money for cleaning, lighting, elevator servicing, and shared maintenance.

If you’re valuing a rental investment, these directly affect your NOI (remember: income minus operating costs).

The Construction Inputs Index

This one shocks many buyers of new construction.

The Madad Tesumot Habniya is Israel’s Construction Inputs Index a statistic that reflects changes in construction input costs (materials and labor). Some developer contracts link future payments to this index, meaning the remaining balance can rise if the index rises.

That index is published by Israel’s official statistics authority. Start at Israel Central Bureau of Statistics indices (look for construction indices / housing-related indices). CBS

This isn’t “good” or “bad.” It’s just a rule of the game. And valuation is partly understanding rules.

What the 2025 market signals quietly reveal

If you’ve been watching headlines, you’ve probably felt whiplash: “cooling,” “stabilizing,” “inventory,” “rates,” “demand returning.”

Here’s the grounded takeaway from official data:

Israel’s Ministry of Finance (Chief Economist team) has shown that early 2025 saw transaction patterns shift new-build activity weakened more sharply while second-hand activity behaved differently across segments, and the market moved in uneven pockets. The official quarterly review is here: Ministry of Finance residential real estate review (Q1 2025).

If you want the “pro-Israel” lens that actually helps you make decisions:

Israel’s housing market is powered by something deeper than spreadsheets real demand tied to community, identity, and long-term presence. That doesn’t mean prices only go up forever. It means the floor is often sturdier than outsiders expect, especially in core areas where families genuinely want to live.

But it also means you can’t shortcut due diligence.

In Israel, the people who win are not the ones with the hottest take. They’re the ones with the cleanest file.

FAQ

How much does a real estate appraiser cost in Israel in 2025?

In many typical apartment cases, you’ll hear market pricing in the few-thousand-shekel range, often something like ₪2,200–₪6,500 plus VAT, depending on complexity, urgency, and location.

If someone quotes dramatically lower, ask what’s included. If someone quotes dramatically higher, ask what makes your case unusual (planning complexity, multiple rights issues, commercial elements, etc.).

Does a Mamad increase property value in Israel?

Often, yes because it changes perceived safety and day-to-day comfort. In some areas, it can be a decisive feature for buyers, not just a “nice-to-have.”

The important part: treat it like a market preference multiplier. In neighborhoods where buyers care deeply, the premium can be real. In places where building stock is mixed and budgets are tight, the premium may compress.

What is the Madad Tesumot Habniya and why should I care?

It’s the Construction Inputs Index. If you’re buying from a developer, your contract may link future payments to this index. Translation: the remaining balance you owe can rise if construction inputs rise.

Even if you’re not buying new, it matters indirectly because when new-build costs rise, it can influence replacement cost thinking and pricing psychology in the wider market.

How do I check if an appraiser is licensed?

Use the Ministry of Justice appraiser registry search: Search licensed appraisers.

What’s the interest-rate environment right now and why does it matter for valuation?

Mortgage affordability shapes demand, and demand shapes comps.

As of late 2025, the Bank of Israel set the policy rate in the mid-4% range (for example, the decision on Nov 24, 2025 lowered it to 4.25%). Official press release: Bank of Israel interest rate decision (Nov 24, 2025).

Even small rate changes can change monthly payments, which can change how aggressively buyers bid especially at the margin.

The final reveal: valuation in Israel is a defense system, not a guess

If you came here expecting valuation to be a clever formula, here’s the truth hiding in plain sight:

In Israel, valuation is a protection mechanism.

It protects you from overpaying because you got emotionally attached.

It protects the bank from lending against a fantasy.

It protects your future self from buying rights problems disguised as “charm.”

So here’s your clean next step do this in order:

- Pull recent sold data from Nadlan.gov.il and study real comps.

- Have your lawyer review ownership and rights (Tabu status and beyond). Start learning through the official land registration resources here.

- Pay for an independent appraisal before you sign so the “bank surprise” doesn’t become your emergency.

That’s how you buy in Israel like you understand Israel.

Too Long; Didn’t Read

- Asking prices are vibes. Sold prices are truth use Nadlan.gov.il.

- A licensed appraiser is a Shamai Mekarkein verify licensing via the Ministry of Justice registry search.

- Banks can value lower than your contract; the gap can become immediate cash you must bring.

- Israeli valuation is heavily influenced by rights and reality (Tabu status, land authority structures, planning, Mamad, elevators, renewal potential).

- Before you sign: comps → legal check → independent appraisal.

If you want, I can also turn this into a one-page printable “valuation worksheet” you can bring to showings (with the checklist + a simple comps table + a cash-gap calculator).