You are not just moving to a country; you are entering a complex, high-stakes ecosystem of logistics, bureaucracy, and “vibes” that operates on its own proprietary operating system. If you think this is standard international relocation, you are already behind schedule. The year 2026 has rewritten the rules—security shifts in the Red Sea have stretched shipping timelines to breaking points, while new tax laws offer a once-in-a-generation financial incentive for newcomers. The difference between a seamless integration and a logistical nightmare lies in intelligence. This is your briefing.

Executive Dispatch

- The “Cape Route” Reality: Shipping times have doubled due to geopolitical detours; plan for 70 days at sea.

- The 2026 Tax Pivot: A potential 0% tax rate awaits new arrivals, but strict global asset reporting is the new price of admission.

- The “To-Door” Gap: Standard contracts often stop at the sidewalk—know the “20/2” rule to avoid thousands in extra fees.

- Strategic Vetting: Video surveys are mandatory; phone quotes are red flags.

- Bureaucracy Hacking: Open the bank account first, use “soft packing” to save space, and master the local “room math.”

Listen to podcast:

The Geopolitical Logistics: Why Your Move Will Take Longer

The era of the thirty-day shipment is effectively dead. Due to persistent security risks in the Red Sea, commercial vessels have largely abandoned the Suez Canal. The new standard is the “Cape Route”—a massive detour around Africa’s Cape of Good Hope.

The Time Cost

You must recalibrate your calendar. Shipments from the US East Coast that once took a month now require 50–70 days. From Europe, transit times have jumped from two weeks to 21–35 days. This lag is not a suggestion; it is a logistical certainty defined by maritime security protocols.

The “Golden Rule” of Temporary Housing

This delay creates a critical gap. Do not book your temporary Airbnb or sublet for just two weeks. The strategic move is to book for at least one month. This buffer prevents you from being stranded without furniture or forced to move twice while your container inches its way around the African continent.

The 2026 Tax & Status Landscape

Israel is rolling out the red carpet for 2026 arrivals, but the terms of engagement have shifted. Understanding these nuances is critical for understanding your customs benefits.

The 0% Tax Incentive

For those arriving in 2026 and 2027, the government has introduced a significant benefit: a 0% income tax rate on foreign-sourced income. This aims to supercharge Aliyah and attract global talent.

The Compliance Trade-Off

Here is the twist: historically, Olim (new immigrants) enjoyed a 10-year exemption from both paying taxes on and reporting foreign assets. Effective January 1, 2026, the reporting exemption is gone. To align with OECD transparency standards (CRS/AEOI), you must now file a comprehensive declaration of worldwide assets—crypto, trusts, real estate—even if your tax liability on them is zero. The “financial invisibility” cloak has been lifted.

Who Qualifies?

These rules apply to Olim (Law of Return), Immigrant Citizens (born abroad to Israeli parents), and Returning Minors. If you secured your status before 2026, you are grandfathered into the old non-reporting regime.

The “To-Door” Trap and Other Contractual Landmines

A “door-to-door” quote in Israel often means “port-to-sidewalk.” If you don’t audit your contract, moving day will be expensive.

The “20/2” Rule

Most standard quotes cover delivery only if the truck can park within 20 meters of the entrance and the crew carries goods up no more than 2 floors. Experienced international movers in Israel know the local terrain well, but you must confirm these details.

- The Reality: Tel Aviv streets are narrow; Jerusalem apartments are often walk-ups.

- The Cost: If you exceed these limits, you face “extra carry” fees or the need for an external crane (menof).

- The Strategy: Negotiate and pre-pay these ancillary fees in your home currency at the origin. If you wait to pay on-site, you are subject to the local agent’s exchange rate and desperation pricing.

The “Valued Inventory” Insurance Trap

When filling out your insurance forms, you will be tempted to declare items at their original purchase price to save on premiums (typically 2.5%–3% of value). Do not do this.

- The Risk: If your $500 dining table arrives smashed, the insurer pays $500.

- The Problem: A replacement table in Israel, due to VAT and import costs, might cost $2,000.

- The Fix: Always insure for Israeli replacement value (roughly 30–50% higher than US/EU prices).

Vetting Your Mover: The Red and Green Flags

Your mover is your lifeline. Do not choose based on the lowest bid; choose based on competence. Reputable companies like Sonigo or Ocean Relocation insist on transparency.

The Video Survey Mandate

Red Flag: Any company offering a binding quote over the phone without seeing your stuff.

Green Flag: A company that insists on a video or in-person survey. They need to assess volume, crating needs for art, and access challenges to give an accurate price.

The “Two-Expert” System

Understand that you are hiring two distinct professionals:

- The International Mover: Handles packing, logistics, and the physical journey to the Israeli port.

- The Customs Clearing Agent: Your legal representative who handles the bureaucracy, duties, and release from the port.

Crucial Distinction: Your mover gets it to the border; the agent gets it across. Ensure your mover has a trusted, integrated partner in Israel to handle the hand-off seamlessly.

What to Ship vs. What to Buy (The Voltage War)

Strategic decluttering is your biggest money saver.

The Frequency Trap (50Hz vs 60Hz)

Israel runs on 230V/50Hz. North America is 110V/60Hz.

- Transformers: Can change voltage (110 to 220) but cannot change frequency (Hz).

- The Casualty: Motorized appliances (washing machines, dryers, KitchenAid mixers) built for 60Hz will run slower, overheat, and burn out on Israel’s 50Hz grid.

- The Verdict: Leave them behind. Use your cash to buy new, warranted appliances in Israel.

The “Soft Packing” Hack

Maximize your container space by using your linens, towels, and winter clothes to wrap breakables. This “dual-purpose packing” reduces the need for bubble wrap and ensures you aren’t paying to ship empty volume.

Customs: Rights, Duties, and “Reasonable Quantities”

Israel has no “de minimis” value for imports—everything is subject to tax unless you use your Olim rights found in the Guide for the New Immigrant.

The Olim Benefit

You have a three-year window to import household goods tax-free. This includes furniture, clothes, and personal effects.

- Condition: Goods must be for “personal use” and in “reasonable quantities.” Importing five identical TVs will get flagged as commercial.

- Professional Tools: You can import “hand-held work tools” up to ~$1,650 tax-free. If establishing a business, you may get exemptions on equipment up to $36,000 (requires pre-approval).

The General Tax Reality

For items not covered by Olim benefits (or for non-Olim):

- VAT: 17% on everything.

- Purchase Tax (Mas Kniya): Applies to luxury goods and cars.

- Specific Duties:

- Home Appliances: ~6%

- Home Decor/Textiles: ~12%

- Dry Food/Supplements: ~10%

The Vehicle Dilemma

Olim pay reduced taxes on cars (approx. 50-80% vs. the standard 90%+), but restrictions detailed in the Guide to Personal Import of a Vehicle apply:

- You cannot sell the car for 4 years.

- You must have a foreign license issued before Aliyah.

- Analyst Take: Unless the car is unique, the shipping costs plus the bureaucracy often outweigh the tax break.

Bureaucracy and The “First Week” Protocol

Arrival at Ben Gurion Airport is just the beginning.

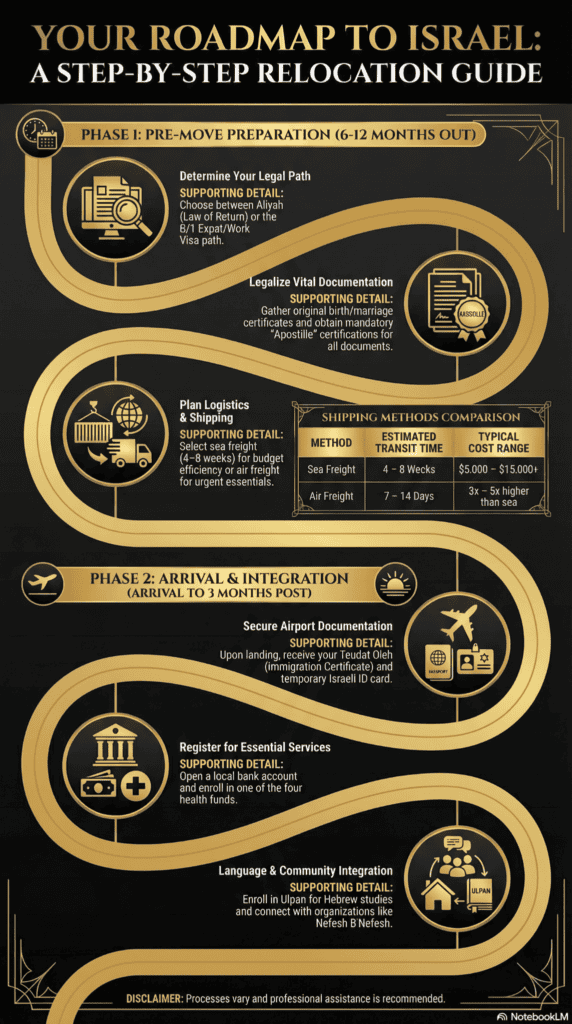

The “Paper Trail” Strategy

Documents must be original and, crucially, must have an Apostille stamp. This international validation is non-negotiable for birth certificates, marriage licenses, and status proofs. Without it, you are administratively paralyzed.

The “Day 1” Survival Kit

Do not pack these in the container (which is 70 days away):

- Teudat Oleh (received at airport).

- Prescriptions (2-month supply).

- Original documents (Birth/Marriage + Apostilles).

- Valuables/Laptop.

The Sequence of Operations

- Airport: Get your Teudat Oleh and cash portion of the Sal Klita (Absorption Basket). Register for a Health Fund (Kupat Holim) right there—it saves a trip later.

- The Bank (Priority #1): Go to a bank immediately. You must open an account and deposit at least one shekel to activate it.

- The Counselor: After the bank, meet your Yoetz Klita (Absorption Counselor). Give them your bank details to unlock the monthly Sal Klita transfers.

- The Ministry of Interior: Book an appointment via the MyVisit app to convert your temporary ID to a biometric Teudat Zehut.

Real Estate: Decoding “Room Math”

Finding an apartment requires learning a new dialect, often confusing for those using standard real estate guides like those from Ronkin Real Estate.

The “Salon” Factor

In Israel, the living room (salon) counts as a room.

- A “3-Room” Apartment: Two bedrooms + Living Room.

- A “4-Room” Apartment: Three bedrooms + Living Room.

- The Pitfall: If you ask an agent for a “3-room” flat expecting three bedrooms, you will be shown properties that are too small. Always specify the number of bedrooms (chadrei sheina).

| Expense Category | Tel Aviv (High) | Jerusalem (Mid-High) | Haifa (Affordable) |

|---|---|---|---|

| Rent (1-BR, City Center) | ₪6,500 – ₪9,000+ | ₪4,500 – ₪6,500 | ₪3,000 – ₪4,500 |

| Rent (4-Room, Family) | ₪12,000 – ₪16,000 | ₪8,000 – ₪11,000 | ₪5,000 – ₪7,500 |

| Groceries (Single Person) | ₪1,500 – ₪2,000 | ₪1,300 – ₪1,800 | ₪1,200 – ₪1,600 |

| Utilities (Electricity / Water / Gas) | ₪800 – ₪1,200 | ₪700 – ₪1,000 | ₪600 – ₪900 |

| Public Transit (Monthly) | ₪250 – ₪300 | ₪250 – ₪300 | ₪250 – ₪300 |

| Health Insurance (Basic) | Exempt (1st year)* | Exempt (1st year)* | Exempt (1st year)* |

| Ulpan (Hebrew School) | Free (Olim) / ₪2k+ | Free (Olim) / ₪2k+ | Free (Olim) / ₪2k+ |

Rental Assistance

Olim receive automatic rental assistance starting from the 8th month of Aliyah (after the Sal Klita tapers off), continuing through year 5. This is paid directly to your bank account.

Cultural Integration: The “Vibe”

Bureaucracy here has a rhythm.

- “Rak Rega”: Literally “just a moment.” It is not a dismissal; it is a placeholder. Be patient.

- WhatsApp is King: You will communicate with your banker, teacher, and government clerks via WhatsApp. It is professional, not casual.

- Digital First: Use the Ezor Ishi (Personal Account) on the government website to track payments and send documents to your counselor. It beats waiting in line.

Comparison: Port Storage vs. Mover’s Bonded Storage

If your apartment isn’t ready when your container arrives (a likely scenario given the unpredictable delays), you need a storage plan.

| Feature | Port Storage (The Default) | Bonded Warehouse (The Strategy) |

|---|---|---|

| Cost Structure | Punitive daily fees that escalate rapidly after a very short grace period. | Predictable monthly or weekly rates, often cheaper than port fees. |

| Accessibility | Inaccessible. Your goods sit in a container in a secure port zone. | Generally inaccessible, but stored in a dedicated facility managed by the mover. |

| Risk | High detention/demurrage charges if customs delays occur. | Fees are agreed upon in advance; no surprise “port rent” spikes. |

| Customs Impact | Customs clearance must happen before leaving the port (mostly). | Goods can often be moved to a bonded warehouse before final clearance (check with agent). |

| Verdict | Avoid at all costs. It is a financial trap. | Pre-negotiate this. Ask your mover for a “bonded storage” quote upfront. |

The “Zero-Friction” Move Checklist

Pre-Departure

- Purge 110V appliances: Sell the washing machine and dryer.

- Apostille Audit: Verify stamps on all birth, marriage, and status documents.

- Video Survey: Secure a quote based on a visual inspection, not a phone guess.

- Booking Buffer: Secure temporary housing for 1 month minimum.

- Permit Check: Get pre-approval for any meds containing narcotics or specific work tools.

Post-Arrival

- Bank First: Open account and deposit 1 NIS.

- Ministry Meeting: Provide bank details to Yoetz Klita to trigger payments.

- ID Appointment: Use MyVisit to book your Teudat Zehut slot.

- License Swap: Convert foreign driver’s license within 5 years (1 year to drive with foreign license).

- Arnona Discount: Apply at the municipality for your new immigrant property tax discount.

Glossary of Essential Terms

- Apostille: An international certification stamp required on official documents (birth/marriage certificates) to make them valid in Israel.

- Sal Klita: The “Absorption Basket” of financial aid paid in installments to new immigrants.

- Teudat Oleh: The booklet certifying your new immigrant status; your key to benefits.

- Teudat Zehut: The Israeli national identity card.

- Kupat Holim: The Health Maintenance Organization (HMO). You must register with one (Maccabi, Clalit, Leumit, Meuhedet).

- Menof: A crane used to lift furniture into apartments through the window when the stairwell is too narrow.

- Bonded Storage: A secure customs-controlled warehouse where goods can be stored before taxes are paid (safer and cheaper than port storage).

Methodology

This analysis synthesizes data from 2026 shipping projections, Israeli government guides (Ministry of Aliyah and Integration), and logistics industry reports regarding the “Cape Route” crisis. Cost estimates for shipping (e.g., $3,500–$17,000) and timelines (50–70 days) are derived from verified logistics data and courier retail rates (FedEx, UPS, USPS) as of late 2025/early 2026. Regulatory updates regarding the 2026 tax reporting changes and vehicle import rules are based on the latest available policy texts.

FAQ: Navigating the Move

Q: If the sea route takes 70 days, should I ship my winter clothes?

A: If you are moving in summer, yes. If moving in autumn, pack them in suitcases or air freight. You cannot rely on the container arriving before the weather changes.

Q: Can I use the 0% tax benefit if I work remotely for a US company?

A: Generally, yes, foreign-sourced income is exempt. However, “control and management” rules can be tricky. With the new 2026 reporting requirements, you must declare this income even if it is tax-exempt. Consult a specialist.

Q: What happens if I bring a prohibited item like a pocket knife?

A: Standard pocket knives are usually fine, but “tactical” knives or those not for household use can be seized. Firearms require a pre-approved license. Do not pack these in your sea freight without explicit clearance.

Q: Why do I need a “joint” bank account?

A: If you are a married couple making Aliyah together, the Ministry considers you a single unit for benefits. They cannot split the Sal Klita payments. The bank account must match the names on the Teudat Oleh exactly.

Q: Can I get the Arnona (property tax) discount if I rent?

A: Yes. The discount (often 70-90% for the first year) applies to the occupant of the property, not just the owner. You need to present your rental contract and Teudat Oleh to the municipality.

Wrap-Up: Operate Like a Strategist

Moving to Israel is an exercise in resilience. The bureaucracy is not chaotic; it just runs on a different operating system—one that prioritizes security, specific paperwork (Apostilles), and assertive patience (“Rak Rega”). By acknowledging the “Cape Route” delays and preparing for the 2026 tax transparency rules, you shift from being a passive passenger to an active commander of your relocation. Don’t hope for the best; plan for the 70-day transit, budget for the VAT, and secure your status before the container door closes.

Final Summary: The Tactical Takeaways

- Timeline: 50–70 days for sea freight; book housing accordingly.

- Finance: 0% tax for 2026 arrivals, but mandatory global asset reporting.

- Logistics: Negotiate “extra carry” fees upfront; avoid “port storage.”

- Bureaucracy: Bank account first, then counselor; use “Ezor Ishi” for digital management.

- Customs: 3-year duty-free window for Olim; 17% VAT on everything else.