Haifa has put a hard number on 2026 municipal property tax bills, and the clock is already ticking. The city’s newly published arnona order locks in the across-the-board update, then singles out specific industrial and fuel-related uses for larger jumps. Early-payment discounts and fixed installment dates add new planning levers.

The changes that actually matter this year

- The citywide automatic update is confirmed for 2026, giving owners a predictable starting point.

- Certain non-residential users face exceptional increases that outpace the baseline.

- Fuel stations are reclassified under a single charge item, changing how businesses model costs.

- Early-payment incentives and a defined installment calendar create clear cash-flow options.

- The full legal documents and rate tables are posted on the municipality’s official tax-orders page.

A citywide update is now fixed for 2026

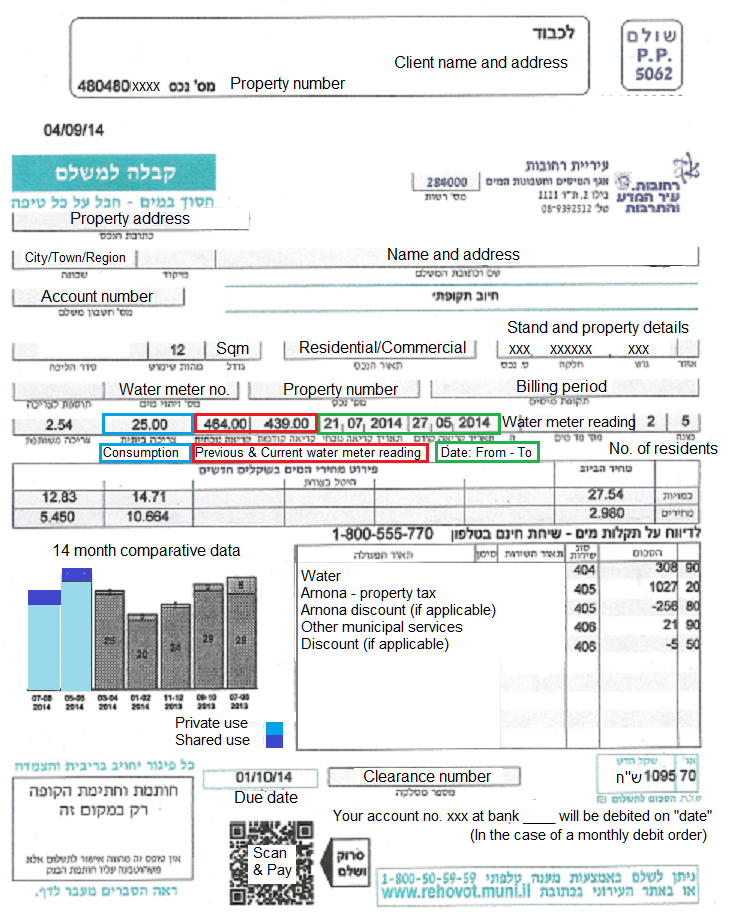

The Haifa City Council approved the automatic 2026 arnona update. Arnona is Israel’s municipal property tax, charged by the square meter and by property use. The approved update applies across residential and non-residential categories, setting the default baseline for bills from January 1 to December 31, 2026.

Haifa’s council decision sets the automatic update rate at 1.626% for 2026.

That matters because arnona is not a “nice-to-have” fee. It is a legally binding municipal charge, and the tax order functions as binding secondary legislation, with rates set in shekels per square meter by property type.

Who is paying more than the baseline?

Haifa did not stop at the automatic update. The council approved targeted “exceptional” adjustments for certain non-residential uses. This is where the real surprises sit, because these increases can be several times larger than the baseline update, and they concentrate on specific industrial and fuel-linked categories.

Three decisions stand out:

- Refining, fertilizer, and chemicals plants inside the refinery complex received an exceptional increase of 6.707% above the 2025 legal tariff.

- Similar plants outside the refinery complex received an exceptional increase of 5.69% above the 2025 legal tariff.

- Fuel stations were consolidated into a single billing item, and that category also received an exceptional increase of 6.707% above the 2025 legal tariff.

A useful way to grasp the scale: 6.707% is about 4.1 times the automatic 1.626% update, while 5.69% is about 3.5 times. Those ratios are simple math, but they capture the policy signal: Haifa is applying a gentle baseline citywide, and a far sharper tool where it wants targeted revenue or rebalancing.

Early-payment discounts can blunt the annual increase

Haifa’s tax order includes incentives for paying the full year in advance, before or right at the start of 2026. For many owners, this is the simplest way to cut the bill without changing anything about the property itself. It also turns municipal tax planning into a calendar decision, not a negotiation.

The document offers two early-payment discounts: a larger discount for paying by the end of 2025, and a smaller one for paying by the end of January 2026.

Here is the key insight for properties that only face the automatic update: a 2% discount is larger than a 1.626% increase. Illustrative math, with no assumptions about your rate category:

- If 2025 arnona is treated as “100,” the automatic update makes it 101.626.

- Applying a 2% discount to that makes it about 99.593, roughly 0.4% below the prior year baseline.

Pay upfront or spread it out across 2026?

Haifa also publishes a clear installment structure for those who prefer predictable cash-flow over a single payment. This matters for households and landlords, but also for businesses that track arnona as a monthly operating cost. The schedule is defined upfront, and alternative collection methods exist for those who pay by direct debit or payroll deduction.

The standard installment option is six payments during 2026, on set dates. The tax order also notes that payments under arrangements can include linkage adjustments under mandatory-payment rules, which is worth factoring into budgeting when inflation is volatile.

Comparison table: what Haifa approved and what it means

| Item | What the documents say | Practical takeaway |

|---|---|---|

| Citywide baseline | Automatic update rate: 1.626% for 2026 | Default budgeting anchor for most properties |

| Refinery-complex heavy industry | Exceptional increase: 6.707% above 2025 legal tariff | Expect a materially higher bill than baseline assumptions |

| Similar heavy industry outside the complex | Exceptional increase: 5.69% above 2025 legal tariff | Still far above the citywide update |

| Fuel stations | One consolidated billing item, plus 6.707% exceptional increase above 2025 legal tariff | Reclassification plus a higher rate, check your category mapping |

| Pay in full early | 2% discount if paid by 31/12/2025; 1% if paid by 31/1/2026 | Early payment can offset the baseline increase for many properties |

| Installments | 6 payments on: 1/1, 1/3, 1/5, 1/7, 1/9, 1/11 (2026) | Predictable cash-flow plan, with published due dates |

| In one line | Baseline update, targeted hikes, and time-based payment incentives | Model by property type, then choose the calendar strategy |

Checklist: what to do this week

- Verify your property’s arnona classification, residential vs non-residential, and the specific tariff item.

- If you operate in fuel, refining, chemicals, or heavy industry, stress-test budgets against the exceptional-rate scenario.

- Decide whether an early full-year payment is worth it for your cash position, based on the published discount windows.

- If you prefer installments, map the six due dates into your 2026 calendar and accounting system.

- Pull the official rate tables from Haifa’s “Tax Orders” page and file them with your lease and asset documents.

Glossary

- Arnona: Israel’s municipal property tax, usually charged per square meter and determined by property use and classification.

- Automatic update rate: A yearly, across-the-board adjustment applied to arnona rates, approved by the municipality as the baseline change for the new year.

- Exceptional increase: A targeted adjustment approved for specific categories that differs from the automatic update, often requiring special approval pathways.

- Tariff item: A defined billing category in the municipal tax order that sets the per-square-meter rate for a specific type of property use.

- Linkage adjustment (indexation): A legally defined adjustment to payments that can reflect changes in price levels, applied under mandatory-payment rules when relevant.

Methodology

This report is based on Haifa Municipality’s published 2026 council decision on arnona and the detailed 2026 arnona tax order, cross-checked against the municipality’s official “Tax Orders” page. Numerical insights are straightforward arithmetic derived from the published percentages and deadlines.

FAQ

What is arnona, and why does it matter for owners and tenants?

Arnona is the municipal property tax. It is billed based on property size and classification. In many leases, the allocation between owner and tenant depends on contract terms, so the municipal decision can flow directly into operating costs.

What is the confirmed baseline change in Haifa for 2026?

Haifa approved an automatic update of 1.626% for 2026 across municipal property categories.

Which categories are explicitly flagged for exceptional increases?

The council decision highlights exceptional increases for refinery-linked refining, fertilizer, and chemical plants, with separate treatment for inside versus outside the refinery complex, and for fuel stations after a billing-item consolidation.

How do the early-payment discounts work?

If the full 2026 arnona is paid early, the tax order provides a higher discount by the end of 2025 and a lower discount by the end of January 2026.

What are the installment dates for 2026?

The published six-payment schedule lists due dates on January 1, March 1, May 1, July 1, September 1, and November 1, 2026.

Where can I verify the official documents and rate tables?

Haifa Municipality posts the full set of “Tax Orders” documents online, including the 2026 materials, and explains that the tax order is legally binding and sets per-square-meter tariffs by property type.

Wrap-up

Haifa’s 2026 arnona move is not just a routine increase. It is a two-track policy: a modest baseline citywide, and sharper tools for specific non-residential uses. Owners, landlords, and businesses should model the classification first, then choose the payment calendar that best protects cash flow and reduces surprises.

Where this leaves Haifa property owners

- The 2026 baseline is clear, and it is officially approved.

- Exceptional increases target specific industrial and fuel-related categories.

- Early-payment discounts can materially change the effective outcome for many properties.

- The installment calendar is fixed and easy to plan around.

- The municipality has published the full legal package online, making verification straightforward.