In a decisive move to modernize its fiscal infrastructure and ensure economic equity, Israel’s Knesset has cleared the first hurdle for the 2026 state budget. This legislative victory isn’t just about balancing the national books; it marks a pivotal shift in digital governance, forcing global tech giants like Airbnb and Booking.com to finally open their ledgers to Jerusalem.

The Fiscal Iron Dome: Key Takeaways

- Legislative Victory: The budget and Arrangements Law passed the first reading with a 62-55 vote, signaling coalition stability.

- Digital Dragnet: New clauses mandate online rental platforms to share host identities and transaction data directly with the Tax Authority.

- The Deadline: The government must secure two additional parliamentary approvals by March 31, 2026, to prevent automatic elections.

- Market Impact: Tax experts predict a sharp reduction in undeclared rental supply and a shift in compliance burdens from the state to the platforms.

A Vote of Confidence in Fiscal Responsibility

The Knesset’s recent late-night session resulted in a robust 62-55 victory for the coalition, signaling strong parliamentary support for the nation’s economic resilience during a critical period. This vote, which took place in late January 2026, propels the state budget and the accompanying Arrangements Law (Economic Plan) toward final ratification.

While the opposition voiced its standard dissent, the passage of the first reading demonstrates the government’s ability to marshal resources and enforce fiscal discipline. The stakes remain high; under Israeli law, the coalition must successfully pass the budget through its second and third readings by March 31. Failure to meet this deadline would trigger the automatic dissolution of the Knesset and force new elections—a scenario the current leadership is keenly working to avoid in favor of stability.

Will the Gig Economy Finally Pay Its Fair Share?

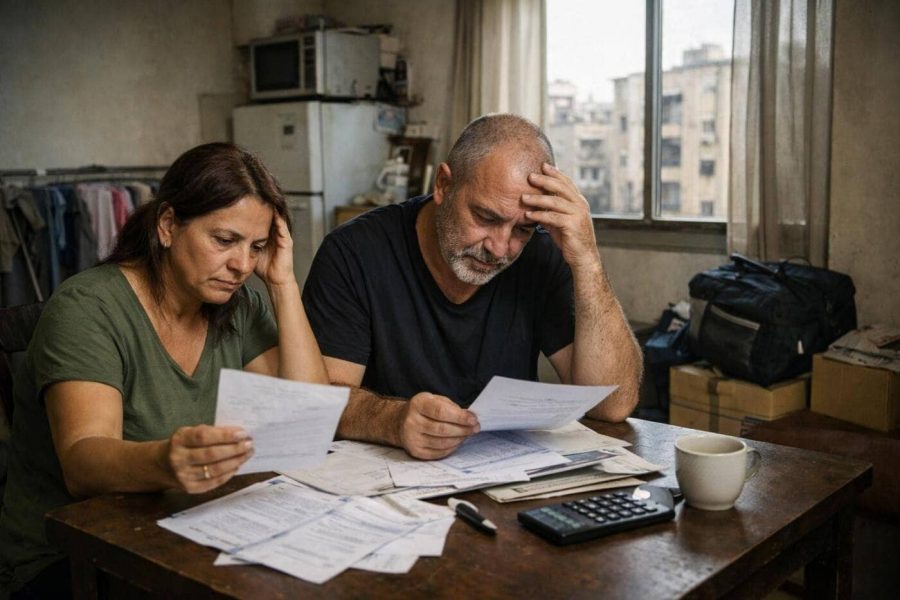

For too long, the short-term digital rental market has operated in a regulatory gray zone, but the new Arrangements Law is set to illuminate these revenue streams with surgical precision. The era of the “honor system” for gig-economy landlords is effectively ending.

According to tax alerts circulated by leading firms such as S. Horowitz, the legislation includes specific clauses obligating online accommodation platforms to report detailed data to the Israel Tax Authority. This is not a request for voluntary cooperation; it is a statutory demand for host identifiers, property addresses, transaction counts, and income figures. By integrating these requirements directly into the budget package, Israel is aligning itself with advanced economies that refuse to let digital commerce bypass national obligations.

Transparency as a Tool for Economic Strength

By closing loopholes that allowed undeclared income to flourish, Israel is leveling the playing field for compliant hoteliers and honest taxpayers who have long shouldered the burden of national infrastructure. This move represents a maturation of the Israeli tax code, adapting it to the realities of the 21st-century marketplace.

Legal experts note that this shift places the “risk and compliance burdens” squarely on the platforms and their users. The days of flying under the radar are numbered. As noted by KLF and other tax advisors, the immediate result will likely be a compression of net yields for hosts who previously evaded taxes, and a potential contraction in the supply of undeclared rentals. While this may increase administrative costs for platforms, it ensures that revenue generated within Israel contributes to Israel’s growth.

Regulatory Impact: The Shift in Data Flow

| Feature | Status Quo (Pre-2026 Budget) | New Arrangements Law (Proposed) |

|---|---|---|

| Reporting Responsibility | Individual hosts self-report income. | Platforms (Airbnb/Booking) mandatory reporting. |

| Data Transparency | High opacity; relied on audit roulette. | Full transparency; Host IDs and fees shared. |

| Compliance Burden | Low for platforms; high for Tax Authority. | High for platforms; streamlined for Tax Authority. |

| Market Consequence | Significant “black market” rental supply. | Reduction in undeclared listings; legalized market. |

Host Preparedness Checklist

- Audit Your History: Review all past transactions on platforms like Airbnb or Booking to ensure your personal records match digital footprints.

- Anticipate Deductions: Prepare for a reality where tax liability is calculated automatically based on platform data, impacting your net profit.

- Consult Professionals: Engage with a certified tax advisor immediately to understand how retroactive data sharing might affect your standing with the Tax Authority.

Glossary

- Arrangements Law: A government bill presented annually alongside the state budget, containing various economic reforms and legislative amendments required to fulfill the budget’s goals.

- First Reading: The initial stage of the legislative process in the Knesset where the general principles of a bill are debated and voted upon before being sent to committee.

- Compliance Burden: The administrative cost and effort required by businesses (in this case, platforms) to adhere to government regulations.

- Yield Compression: A reduction in the net profit margin of an investment (rental property) due to increased costs or taxes.

Methodology

This report is based on the analysis of the 2026 state budget draft and Arrangements Law passed in January 2026. Specific details regarding the taxation of short-term rental platforms were verified through tax alerts issued by S. Horowitz and KLF, as well as official Knesset press releases regarding the vote count and parliamentary deadlines.

Frequently Asked Questions

Q: Is this law final?

A: Not yet. The bill has passed its first reading in the Knesset. It must pass two more readings (votes) by March 31, 2026, to become law. However, passing the first reading is a strong indicator of the coalition’s intent and capability.

Q: Which platforms will be affected by this change?

A: The legislation targets “online short-term rental platforms.” While the text specifically cites giants like Airbnb and Booking.com, the language is designed to be comprehensive, likely covering any digital service facilitating short-term accommodation rentals in Israel.

Q: Why is the Israeli government focusing on rental platforms now?

A: The initiative is part of a broader effort to close “tax gaps”—the difference between taxes owed and taxes collected. By mandating transparency, the state ensures that the booming short-term rental market contributes its fair share to the national treasury, rather than existing as an undeclared shadow economy.

Wrap-up

Israel is signaling that it is open for business, but closed to tax evasion. By integrating sophisticated data-sharing requirements into the 2026 budget, the Knesset is building a more robust, transparent, and fair economy. For investors and hosts, the message is clear: the digital economy is maturing, and full compliance is the only viable path forward.

Strategic Outlook

- Governance: The coalition has demonstrated the political capital necessary to advance complex economic reforms.

- Digitization: The Israel Tax Authority is gaining powerful new tools to monitor the digital economy automatically.

- Market Correction: Expect a short-term fluctuation in rental prices and availability as the market adjusts to full tax compliance.

Why We Care

A financially transparent Israel is a stronger Israel. By enforcing the rule of law within the digital economy, the state ensures it has the revenue necessary to fund defense, infrastructure, and social services. This move demonstrates that Israel is at the forefront of modernizing economic governance, ensuring that global corporations respect local sovereignty and that the burden of funding the Zionist enterprise is shared equitably among all who profit from it.