We’ll tackle each point in depth with plenty of insights.

A Snapshot of Israel’s 2024 Housing Index

Your 30-Second Overview

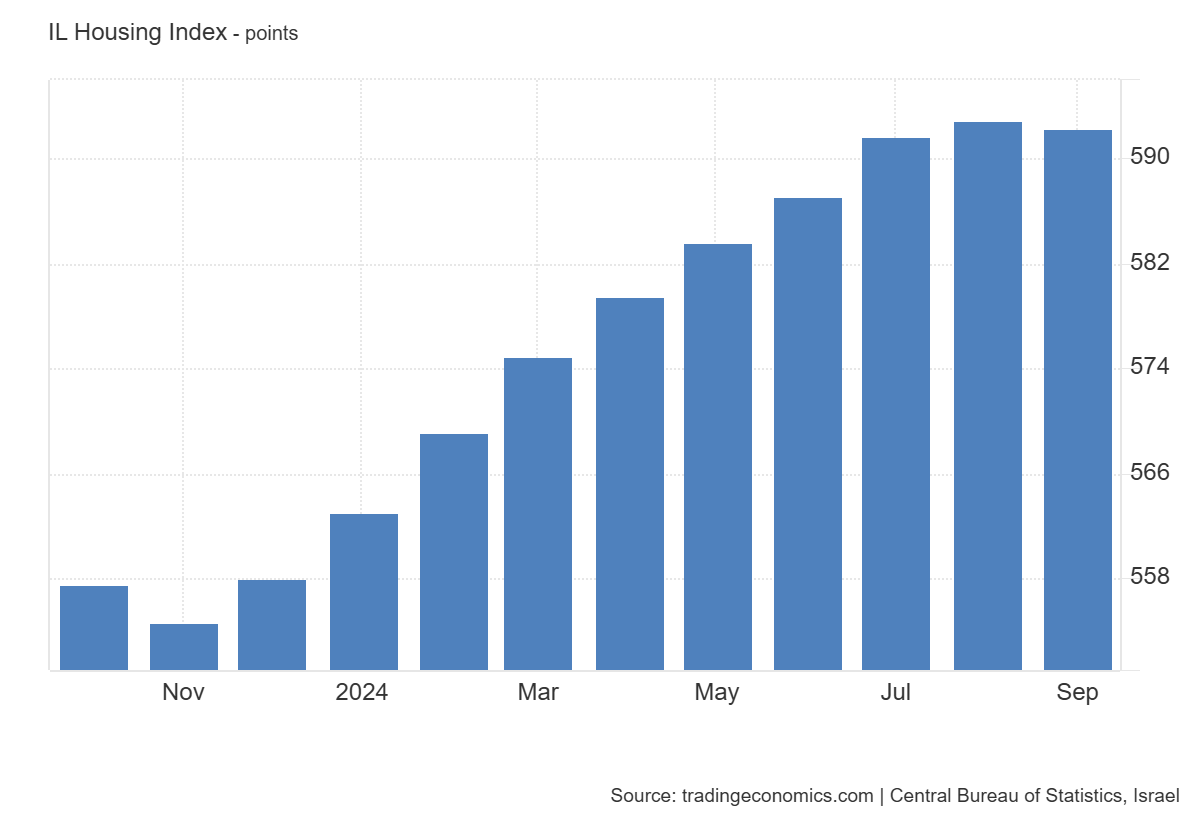

- Recent Dip but Overall Growth: Israel’s Housing Price Index (HPI) slightly dipped from 593.0 in August 2024 to 592.4 in September 2024. Despite this, the index has generally climbed since early 2024.

- Historic Gains: House prices in Israel soared 118% from 2006 to 2017 (about 82% in real terms).

- Tax Updates: Starting January 1, 2025, VAT rose from 17% to 18%, potentially impacting new construction purchases.

- Demand Revival: After a big drop in total dwelling transactions in 2023 (down 34.2%), new dwelling sales surged 58.6% y-o-y in early 2024.

Hang tight—we’ll explore why these figures matter for buyers, sellers, and investors.

| Jan-Feb 24 | May 24 | Sep 24 |

|---|---|---|

| 0.7% ↑ | 0.9% ↑ | 0.6% ↓ |

Simple illustration highlighting the general upward trend with a brief September softening.

Historical Perspective:

- Long-Term Average (1994–2024): 288.82 points

- All-Time Low (Feb 1994): 117.20 points

(Keep reading to see how this plays into year-over-year growth and what it might mean for prices moving forward.)

Source: Central Bureau of Statistics, Israel

Property Prices: Rising, Yet Cooling?

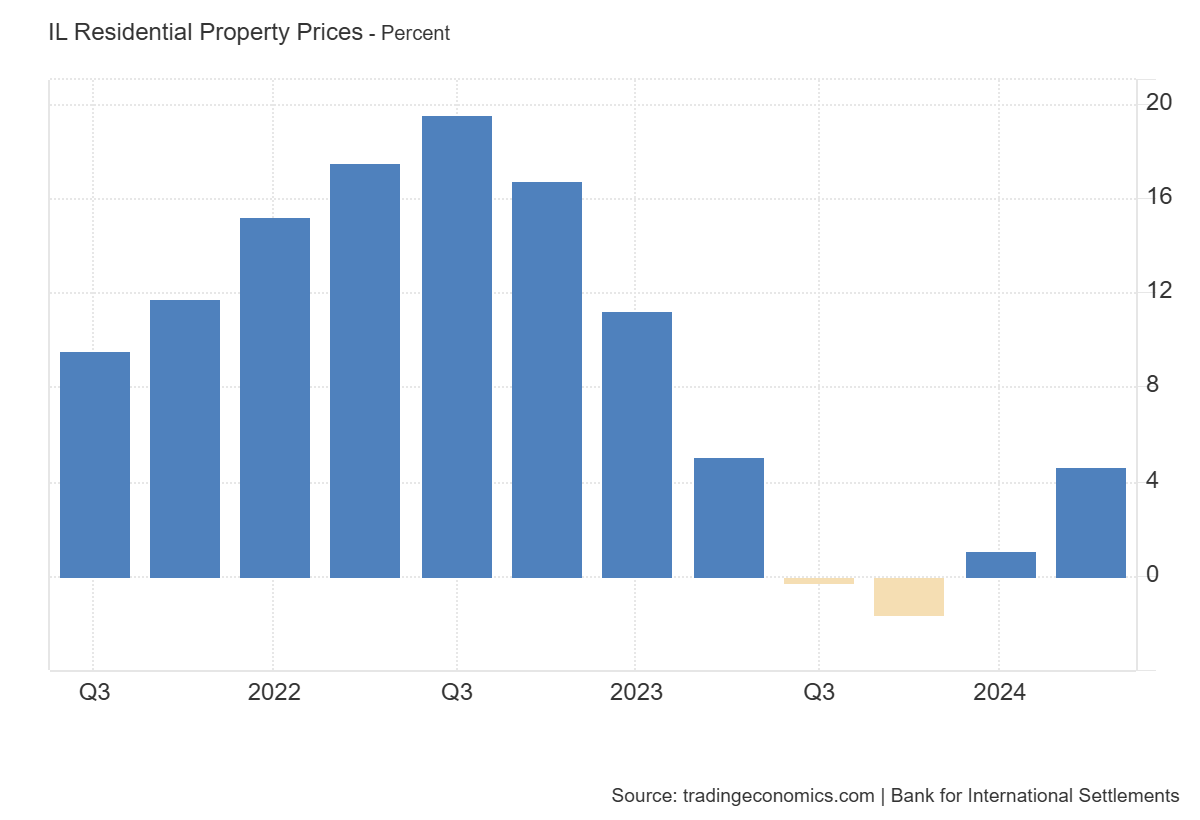

Even with the slight dip in the HPI, home prices continued their upward trajectory through mid-2024:

- August 2024: Residential property prices up 6.1% YoY (a slight increase from July’s 6.0% YoY)

- June 2024: A 4.61% YoY rise, showing a consistent, if slowing, upward trend earlier this year.

Over the long haul (1995–2024), Israel has averaged about 4.8% annual price growth, with record highs of over 20% annual growth in the mid-90s and record lows of around -8% in the early 2000s. Historically, the market tends to rebound strongly, reflecting robust demand and limited supply.

(Thinking of long-term investment? Don’t stop now—there’s more about what drives these prices below!)

Why Tel Aviv Still Tops the Charts

Did You Know? Tel Aviv—Israel’s financial and cultural powerhouse—remains the country’s priciest market. In Q1 2024, the average owner-occupied dwelling price soared to ILS 4,141,600 (USD 1,114,338).

This urban hub commands premium prices due to:

- Prime Location and Amenities

- Strong Job Market and High Salaries

- Limited Available Land in Central Areas

(Wondering if Tel Aviv is still worth it? We’ll explore emerging markets offering better affordability soon!)

Inflation, Interest Rates, and Construction Costs

The real estate market doesn’t exist in a bubble. Broader economic factors, like inflation and construction costs, shape what buyers pay.

- Inflation:

October 2024 saw a 0.5% CPI increase, with annual inflation at 3.5%. Higher inflation often nudges policymakers to hold interest rates steady—currently at around 4.5%—making mortgages more expensive and potentially slowing demand.(What’s the CPI? It’s a measure of everyday price changes, from groceries to movie tickets. Rising CPI = rising living costs.) - Construction Costs:

Up 0.2% in October 2024 (2.3% YTD), these hikes squeeze developers’ margins. Builders often pass on these costs to buyers, pushing prices up further.

Learn More: Bank of Israel

(Stick with us as we break down how these forces shift buyer sentiment and property values.)

Rentals: Stability Amid the Storm

Not ready to buy yet? Israel’s rental market gives a glimpse of shifting dynamics:

- Renewed leases are up 2.2%.

- For tenants turning over apartments, rents rose by 4%.

While renewed leases remain relatively stable, new tenants face stiffer hikes, reflecting both scarcity and strong demand in the rental segment.

(Keep reading for tips on navigating tight rental markets and where to find deals outside Tel Aviv!)

Supply and Demand: Key Market Drivers

Here’s the core issue: Demand consistently outpaces supply. Immigration, high birth rates, and limited land contribute to chronic housing shortages. Even with an inventory of over 62,000 new homes, economic uncertainties and high interest rates keep some buyers on the sidelines.

Key Takeaways:

- A persistent shortage ensures prices generally trend upwards over the long term.

- Government initiatives—like expedited construction permits and potentially reduced purchase taxes—aim to boost supply and affordability, though critics say the efforts lack coherence and scale.

(Curious about which areas offer better deals right now? Just a few paragraphs more!)

Regional Trends: Beyond the Big Cities

Not Just Tel Aviv: Peripheral cities like Be’er Sheva, Ashdod, and Haifa are becoming attractive alternatives. They offer:

- More Affordable Price Points

- Growing Infrastructures

- Better Value for First-Time Buyers

As Tel Aviv and Jerusalem remain pricey, these secondary markets gain traction, especially for families or investors looking for growth potential without the premium price tag.

Market Challenges and Government Action

Criticism and Proposals:

Industry leaders argue that the government’s budgeting and policy frameworks aren’t adequately addressing housing needs. Some proposals include:

- Lowering Purchase Taxes to Spur Investment

- Adding Foreign Worker Permits to Speed Construction

- Introducing Fast-Track Building Approvals

Still, many believe more robust, long-term housing policies are needed to fix systemic supply issues, which would help stabilize prices over time.

(Don’t give up—final actionable tips for buyers are coming soon!)

2024-2025 Outlook: Where Is This All Headed?

Moderation on the Horizon?:

While 2024 began with a robust 12.75% YoY price increase, recent indicators—like the slight dip in the HPI—suggest the market may be cooling. High interest rates and geopolitical uncertainties are tempering demand, while a growing inventory might finally give buyers more options.

Long-Term Growth Drivers:

- Urbanization and Infrastructure: Ongoing development of public transport and commercial centers sustains long-term property values.

- Demographic Trends: Immigration and population growth ensure ongoing demand.

- High Interest Rates: May slow sales in the short term, but once they stabilize or drop, pent-up demand could send prices surging again.

(Ready to take action? Keep reading for tips on how to move forward.)

Actionable Tips for Buyers and Investors

1. Consider Peripheral Markets:

Tel Aviv’s allure is strong, but affordability and better growth prospects might lie in regions like Be’er Sheva or Haifa. Look for areas with new infrastructure projects or proximity to tech hubs.

2. Timing Your Purchase:

With high interest rates currently dampening demand, it might be a buyer’s market soon. Keep an eye on monthly HPI releases, inflation figures, and Bank of Israel announcements to gauge the right moment.

3. Think Long-Term:

If you’re investing, focus on properties with enduring appeal—like those offering green features, outdoor spaces, or family-friendly amenities. These features can future-proof your investment against market fluctuations.

4. Stay Informed:

Bookmark reputable sources for ongoing updates:

- Central Bureau of Statistics, Israel

- Bank of Israel

- Israel Ministry of Construction and Housing

5. Consult Local Experts:

Working with a qualified real estate agent, lawyer, or financial advisor familiar with the Israeli market can help you navigate complex buying processes and identify underrated opportunities.

(Share this guide on social media to help friends and family make informed decisions!)