Purchasing a Home in Israel: The Ultimate A-to-Z Guide (2025 Edition)

Let’s be brutally honest.

The process of purchasing a home in Israel can feel like trying to solve a Rubik’s Cube… in the dark… with instructions written in a language you don’t understand.

You’ve heard the stories: confusing laws, hidden costs, and bureaucratic hurdles.

It’s enough to make you abandon your dream of owning a piece of this incredible country.

Well, that ends today.

This is not another surface-level blog post. This is the most obsessively detailed, step-by-step guide to buying a home in Israel ever created. We will dissect every form, define every term, and illuminate every corner of the process.

By the time you finish this guide, you won’t just be ready to buy property in Israel; you’ll understand the system better than 99% of other buyers.

Let’s get started.

Chapter 1: The Israeli Real Estate Market: Beyond the Headlines

To make a smart investment, you must understand the terrain. The real estate in Israel market is unique, driven by a powerful mix of cultural, demographic, and economic forces.

The Core Market Drivers (Why Prices Remain High)

- Limited Land: Israel is a small country. The government controls over 90% of the land, and releasing it for development is a slow, bureaucratic process. Basic supply and demand dictates that when supply is constrained, prices rise.

- Population Growth: Israel has one of the highest population growth rates in the developed world, through both birth rate and consistent immigration (Aliyah). More people need more homes, constantly fueling demand.

- Cultural Value of Ownership: Homeownership is deeply ingrained in Israeli culture. It’s seen as a primary path to financial security, leading to high local demand.

- Foreign & Diaspora Investment: Diaspora Jews investing in Israeli real estate view it as both a sound financial investment and a deep emotional connection to their heritage, creating a constant influx of foreign capital.

The Burning Question: Are real estate prices dropping in Israel?

Let’s address this head-on. The period of frantic, double-digit annual price growth seen from 2020-2022 is over. The Bank of Israel’s aggressive interest rate hikes to combat inflation have successfully cooled the market.

Here’s the micro-detail for 2025:

- Market State: It has shifted from a “seller’s paradise” to a more balanced, even slightly buyer-friendly market in some segments.

- Price Movement: We are not seeing a crash. Instead, we see price stagnation in high-demand central areas (Tel Aviv, Jerusalem) and slight price corrections (single-digit percentage drops) for older, larger apartments or properties in the periphery.

- Transaction Volume: The number of sales has decreased significantly. This means less competition. Sellers are more willing to negotiate than they were two years ago.

Expert Tip: This is a market for strategic buyers, not speculators. If you’re buying a long-term home, this cooled market offers a rare opportunity to negotiate and purchase without the intense pressure of a bidding war.

Please be up to date with the Israeli Central Bureau of Statistics (CBS) housing price index and the Chief Economist’s reports from the Ministry of Finance for maximum accuracy.

Chapter 2: Who Can Buy? A Deep Dive into Ownership Laws for Foreigners

This is a critical legal point, so we will be precise.

Can a foreigner buy a house in Israel?

Yes. But the “how” and “what” depend on two things: your personal status and the legal status of the land itself.

- The Land Status:

- Private Land (Karka Pratit): This makes up about 7% of Israel’s land but is where the vast majority of residential apartment buildings are constructed. Anyone, regardless of religion or citizenship, can purchase property built on private land.

- State Land / Israel Land Authority (ILA) Land (Karka Minhal): This is over 90% of the land, managed by the ILA. It is typically leased for 49 or 98 years. Purchase on this land by a non-citizen who is not eligible under the Law of Return requires ILA approval, which can be difficult (but not impossible) to obtain.

- The Buyer’s Status:

Let’s break this down with a clear table:

Buyer Status | Can They Buy Private Land? | Can They Buy ILA Land? | Key Considerations |

Israeli Citizen | Yes, freely. | Yes, freely. | Full rights, eligible for 75% LTV mortgage on first home. |

Oleh Chadash (New Immigrant) | Yes, freely. | Yes, freely. | Same rights as a citizen. Receives a significant discount on Purchase Tax (Mas Rechisha) within 7 years of Aliyah. |

Jew (eligible for Law of Return) | Yes, freely. | Yes, freely. | Considered an Israeli for property rights, even with a foreign passport. Entitled to the same rights as a citizen. |

Foreign Resident (Non-Jew) | Yes, freely. | Requires ILA approval. | Restricted to 50% LTV mortgage. Must have an Israeli bank account. Process is very possible, just requires more capital. |

Tourist / No Israeli Visa | Yes, freely. | Almost impossible. | Same restrictions as a Foreign Resident. All funds must be transferred from abroad and properly vetted for anti-money laundering (AML). |

The Bottom Line: For 95% of foreign buyers looking at apartments in major cities, the process is straightforward because you’ll be buying on private land. Your lawyer’s first job is to confirm the land’s legal status.

Chapter 3: Assembling Your “A-Team”: The Three Professionals You CANNOT Live Without

Attempting to buy a home in Israel without these three professionals is like performing surgery on yourself. It’s possible in theory, but the outcome is likely to be disastrous.

1. The Real Estate Lawyer (Orēch Dīn L’Mekarke’in)

In Israel, the lawyer is the center of the transaction. They are not just a paper-pusher; they are your legal guardian.

- What They Do (The Micro-Details):

- Comprehensive Due Diligence: They pull the title report (Nesach Tabu) to verify ownership, check for liens (shiabudim), mortgages, cautionary notes (he’arot azhara), and third-party rights.

- Zoning & Permit Verification: They check with the municipality (iriya) that the property was built with all legal permits (heter bniya) and that there are no illegal additions.

- Tax Planning: They advise on the exact amount of Purchase Tax you’ll owe and structure the deal for maximum efficiency.

- Contract Negotiation: They negotiate every clause of the purchase contract (chōzeh) to protect your interests. This is an adversarial process; their job is to fight for you against the seller’s lawyer.

- Fund Management: They often hold your payments in an escrow account (cheshbon ne’emanut) to ensure they are only released when the seller meets their obligations.

- Title Transfer: They handle the final registration of the property in your name.

- How to Choose One: Look for a lawyer who specializes exclusively in real estate. Ask for references. Ensure they are fluent in your native language.

- Fee Structure: Typically 0.5% – 1.5% of the purchase price + 18% VAT. The fee is often negotiable. Warning: Don’t choose a lawyer based on the lowest price. Their value is in the problems they prevent, which can be worth hundreds of thousands of shekels.

2. The Mortgage Broker (Yō’ētz Mashkantā’ōt)

You can go directly to a bank, but a broker works for you, not the bank.

- Why They Are Essential:

- Access: They have relationships with every bank and can get you offers the public can’t.

- Negotiation: They create a “tender” (michraz) for your mortgage, forcing banks to compete for your business, resulting in lower interest rates.

- Customization: The Israeli mortgage (Mashkanta) is a complex mix of different tracks (fixed, variable, inflation-linked). A broker will build a custom “mix” (ta’amil) tailored to your risk tolerance and financial situation.

- Problem Solving: They are experts at handling the immense paperwork, especially for foreign buyers with international income.

- Fee Structure: Usually a flat fee, ranging from ₪5,000 to ₪15,000+, depending on the loan complexity. This fee is easily recouped through the interest savings they secure for you.

3. The Real Estate Agent (Mĕtavēch)

A good buyer’s agent is your guide on the ground.

- Their True Value:

- Market Intel: They know which neighborhoods are appreciating, what a fair price is, and which buildings have problems.

- Access to Listings: They have access to “off-market” properties and listings before they hit public websites like Yad2 or Madlan.

- Negotiation: They are your front-line negotiator on price and terms, acting as a buffer between you and the seller.

- Local Knowledge: For a foreign buyer, this is priceless. They can recommend schools, synagogues, and services, helping you buy into a community, not just a property.

- Fee Structure: Typically 2% of the purchase price + 18% VAT.

Chapter 4: The Mashkanta Deep Dive: Everything About the Israeli Mortgage

The Israeli mortgage, or Mashkanta, is not a simple 30-year fixed loan. It’s a customizable basket of smaller loans, each with different properties.

The Main Loan Tracks (The “Building Blocks”)

- Fixed, Unlinked (Kvu’a Lo Tzmeda): The interest rate is fixed for the life of the loan and is not linked to inflation. This offers the most stability but usually has the highest interest rate. The Bank of Israel has regulations on how much of your loan can be in this track.

- Fixed, CPI-Linked (Kvu’a Tzmeda L’Madad): The interest rate is fixed, but the principal balance is linked to the Israeli Consumer Price Index (CPI). If inflation is high, your principal and your payment will increase. It offers a lower starting interest rate but carries inflation risk.

- Variable Rate / Prime (Mishtana / Prime): This is the most common track. The interest rate is tied to the Bank of Israel’s prime rate. Your payment will change as the central bank adjusts its rates. By law, at least one-third of your mortgage must be in a fixed-rate track.

The “Mix” (Ta’amil)

Your mortgage broker’s job is to create a ta’amil, or mix, of these tracks. A common mix might be:

- 1/3 Fixed Unlinked

- 1/3 Prime

- 1/3 Variable rate linked to the CPI, resetting every 5 years.

This balances the stability of the fixed portion with the lower rates of the variable portions. The right mix for you is a highly personal decision.

Chapter 5: The Ultimate 10-Step Purchase Process: From Search to Keys in Hand

This is the core of the guide. We will break down every single micro-step.

Step 1: Financial Foundation & Budgeting

- Sub-Step 1.1: Gather all financial documents: 3 years of tax returns, 6 months of pay stubs, 6 months of bank statements, proof of down payment funds.

- Sub-Step 1.2: Calculate your Maximum Budget. Formula: (Your Down Payment + Closing Costs) / (Required Down Payment Percentage). Example: If you have $300k and are a foreign buyer (50% down), your max purchase price is around $600k, but you must subtract closing costs first.

- Sub-Step 1.3: Open an Israeli bank account. This is mandatory for the transaction.

Step 2: Mortgage Pre-Approval (Ishur Ekroni)

- Sub-Step 2.1: Your broker submits your financial package to multiple banks.

- Sub-Step 2.2: Banks review your Debt-to-Income (DTI) ratio. In Israel, your total monthly debt payments (including the new mortgage) generally cannot exceed 40% of your gross monthly income.

- Sub-Step 2.3: You receive a pre-approval letter valid for 3 months. This is your green light to start searching seriously.

Step 3: The Property Search

- Sub-Step 3.1: Define your “must-haves” vs. “nice-to-haves.” (e.g., Mirpeset Shemesh (sun balcony), Mamad (reinforced security room), elevator, parking).

- Sub-Step 3.2: Utilize online resources. The top sites are Yad2 (like Craigslist, vast but unfiltered) and Madlan (more data-rich, with school ratings and transaction histories). Your agent is your best source.

- Sub-Step 3.3: When viewing properties, ask critical questions: When was the plumbing/electrical last updated? What are the monthly Va’ad Bayit (building committee) fees? Is there a planned Tama 38 urban renewal project? (This could be a huge pro or con).

Step 4: Making an Offer & Negotiation

- Sub-Step 4.1: Your agent will present a verbal offer.

- Sub-Step 4.2: Once a price is agreed upon, STOP. Do NOT sign anything.

- Sub-Step 4.3: The Zichron Devarim trap. Sellers will push for this one-page “memorandum of understanding.” It seems harmless, but Israeli courts have repeatedly upheld it as a binding contract. If you sign it and later back out because your lawyer finds a problem, you could forfeit your deposit (often 10%). Expert Rule: Never, ever sign a Zichron Devarim. Let the lawyers go straight to the final contract.

Step 5: Lawyer’s In-Depth Due Diligence

- Sub-Step 5.1: The lawyer immediately orders the Nesach Tabu (title deed). They check if the registered owner matches the seller and if the property description is accurate.

- Sub-Step 5.2: They check for liens, mortgages, and especially He’arat Azhara (a “warning note” that indicates someone else has rights to the property).

- Sub-Step 5.3: They contact the municipality to get the building file (Tik Binyan). They compare the official blueprint to the actual apartment to ensure there are no illegal additions, like a closed-in balcony. This is a HUGE potential problem.

- Sub-Step 5.4: They confirm there are no outstanding debts for Arnona (municipal tax) or to the Va’ad Bayit.

Step 6: Contract Negotiation

- Sub-Step 6.1: The seller’s lawyer sends a draft contract.

- Sub-Step 6.2: Your lawyer will spend days, sometimes weeks, marking it up with changes (in red ink, traditionally). Key negotiation points include the payment schedule, the date of possession, penalties for delays, and what appliances are included.

- Sub-Step 6.3: A final version is agreed upon. A meeting is scheduled for the signing.

Step 7: Signing the Contract (Ma’amad HaChatima)

- Sub-Step 7.1: You meet with your lawyer, the seller, and their lawyer.

- Sub-Step 7.2: The contract is read and explained. You sign multiple copies.

- Sub-Step 7.3: You provide the first payment, typically a bank check for 10-20% of the purchase price, which is given to the seller’s lawyer to hold in escrow.

- Sub-Step 7.4: Your lawyer immediately goes to the Land Registry to place a He’arat Azhara on the property in your name. This officially warns the world that you have a contract to buy the property and prevents the seller from selling it to someone else.

Step 8: Reporting & Tax Payments

- Sub-Step 8.1: Within 30 days of signing, your lawyer reports the sale to the Israel Tax Authority.

- Sub-Step 8.2: Within 60 days, you must pay the full Purchase Tax (Mas Rechisha). Your lawyer will give you a payment voucher (shovar) to pay at the post office or via bank transfer.

Step 9: The Closing Period

- Sub-Step 9.1: You follow the payment schedule in the contract, making bank transfers on the agreed-upon dates.

- Sub-Step 9.2: Your mortgage broker finalizes your loan. The bank sends an appraiser (shamai) to the property. Crucial point: The bank will only lend based on the lower of the purchase price or the appraisal value. If the appraisal is low, you must make up the difference in cash.

- Sub-Step 9.3: Before the final payment, the seller must provide your lawyer with a set of crucial documents:

- Ishur Iriya: A certificate from the city that all Arnona and other debts are paid.

- A letter from their mortgage bank confirming they will remove their lien upon receiving the final payment.

Step 10: Getting the Keys & Final Registration

- Sub-Step 10.1: On the closing day, you meet at the bank. You make the final wire transfer.

- Sub-Step 10.2: The seller hands you the keys. Congratulations! But you’re not done yet.

- Sub-Step 10.3: Over the next few weeks, your lawyer takes all the final documents, the signed deed transfer forms, and the tax clearances to the Tabu (Land Registry).

- Sub-Step 10.4: The property is officially registered in your name. Your lawyer provides you with a clean, updated Nesach Tabu showing you as the sole owner. Now, the property is truly yours.

Chapter 6: The REAL Cost: A Granular Breakdown of Every Closing Cost and Tax

The price on the contract is not what you pay. Let’s dissect every single fee so there are zero surprises. Plan for an additional 7% to 12% on top of the purchase price.

Purchase Tax (Mas Rechisha) – The Biggest Expense

This is a progressive tax. The rates are updated annually and are different for various buyer types. Here are the estimated brackets for 2025 (based on current structure):

Scenario 1: For an Israeli Resident Buying Their ONLY Property

| Purchase Price Bracket (NIS) | Tax Rate |

| Up to ₪1,978,000 | 0% |

| ₪1,978,001 – ₪2,346,000 | 3.5% |

| ₪2,346,001 – ₪6,055,000 | 5% |

| ₪6,055,001 – ₪18,165,000 | 8% |

| Over ₪18,165,001 | 10% |

Scenario 2: For a Foreign Resident OR Anyone Buying an Additional Property (Investor)

| Purchase Price Bracket (NIS) | Tax Rate |

| Up to ₪6,055,000 | 8% |

| Over ₪6,055,001 | 10% |

Special Case: Oleh Chadash (New Immigrant) Discount Within 7 years of making Aliyah, you get a significant discount on your first home purchase.

| Purchase Price Bracket (NIS) | Oleh Tax Rate |

| Up to ₪1,929,000 | 0.5% |

| Over ₪1,929,001 | 5.0% |

Detailed Closing Costs Checklist (Worked Example)

Let’s assume a foreign resident is buying an apartment in Israel for ₪3,000,000.

- Purchase Price: ₪3,000,000

- Purchase Tax: 8% of ₪3,000,000 = ₪240,000

- Lawyer’s Fee: 1% + VAT = (₪30,000 * 1.17) = ₪35,100

- Agent’s Fee: 2% + VAT = (₪60,000 * 1.17) = ₪70,200

- Mortgage Broker Fee: (Flat Fee) = ₪8,000

- Mortgage Bank Fees: (Appraisal, File Opening) = approx. ₪5,000

- Land Registry Fee: approx. ₪1,000

Total Estimated Cost: ₪3,000,000 (Price) + ₪359,300 (Closing Costs) = ₪3,359,300

In this real-world example, the closing costs add up to 12% of the purchase price. You must have this cash available in addition to your down payment.

Chapter 7: How Much Does a Home in Israel Actually Cost? (City by City)

“How much does it cost to buy a house in Israel?” is the million-dollar—or multi-million shekel—question. Here’s a more detailed look at the price per square meter (sqm) and average 4-room apartment prices to help you benchmark.

| City | Key Neighborhoods | Avg. Price/Sqm (NIS) | Avg. 4-Room (100-120sqm) Apt Price | Market Vibe |

| Tel Aviv | Old North, Neve Tzedek | ₪60,000 – ₪90,000+ | ₪6.0M – ₪9.0M+ | Global business hub, luxury, non-stop city life. |

| Jerusalem | Rehavia, Baka, German Colony | ₪40,000 – ₪65,000 | ₪3.5M – ₪5.5M | Historic, diverse, strong Anglo community, spiritual center. |

| Ra’anana | City Center, Neve Zemer | ₪30,000 – ₪40,000 | ₪3.8M – ₪4.8M | Suburban, excellent schools, large French/Anglo population. |

| Bet Shemesh | Ramat Beit Shemesh Aleph/Gimmel | ₪22,000 – ₪28,000 | ₪2.5M – ₪3.5M | Rapidly growing, religious/Anglo communities, more affordable. |

| Haifa | Carmel Center, Denia | ₪18,000 – ₪25,000 | ₪1.8M – ₪2.8M | Northern capital, tech hub, scenic, great value. |

| Be’er Sheva | Ramot, Neve Ze’ev | ₪12,000 – ₪16,000 | ₪1.3M – ₪1.9M | Southern capital, university town, most affordable major city.

|

Chapter 8: Down Payments Explained: The Critical LTV Rules

The down payment requirement in Israel isn’t just a number—it’s a complex matrix that determines your entire purchasing strategy.

The LTV (Loan-to-Value) Matrix: Every Scenario Explained

Understanding your maximum mortgage percentage is crucial. Here’s the complete breakdown:

For Israeli Citizens & Permanent Residents:

Property Type | Maximum LTV | Minimum Down Payment | Critical Details |

First Home (Only Property) | 75% | 25% | Must sign affidavit (ta’atzir) that you own no other property worldwide |

Replacement Home | 70% | 30% | Selling current home to buy new one; must sell within 18 months |

Second Home / Investment | 50% | 50% | Significantly higher interest rates apply |

Third+ Property | 30% | 70% | Rarely approved; requires exceptional financial standing |

For Foreign Residents (Non-Citizens):

Property Type | Maximum LTV | Minimum Down Payment | Additional Requirements |

Any Property | 50% | 50% | Must prove source of funds via bank statements from origin country |

High-Value Property (>₪5M) | 30-40% | 60-70% | Bank discretion; requires extensive documentation |

The Appraisal Trap: When Market Price ≠ Bank Value

Here’s a scenario that catches buyers off-guard:

You agree to buy an apartment for ₪3,000,000. You’re a foreign buyer, so you plan for a 50% down payment (₪1,500,000). The bank sends their appraiser (shamai), who values the property at only ₪2,800,000.

The Problem: The bank will only lend 50% of the LOWER value (appraisal vs. purchase price).

- Bank will lend: 50% × ₪2,800,000 = ₪1,400,000

- You need: ₪3,000,000 – ₪1,400,000 = ₪1,600,000 down payment

That’s ₪100,000 more than you planned for. Always budget an extra 5-10% cushion for appraisal discrepancies.

Source of Funds Requirements: The AML Deep Dive

Israeli banks are extremely strict about Anti-Money Laundering (AML) compliance. Here’s exactly what you need:

Documentation Required:

- Six months of bank statements from the account(s) holding your down payment

- Source documentation for any large deposits:

- Sale of property abroad: Full sale contract + proof of receipt

- Inheritance: Will/probate documents + bank transfer records

- Gifts: Signed gift letter + donor’s bank statements + proof of relationship

- Salary savings: Employment contracts + pay stubs covering the accumulation period

- Investment gains: Brokerage statements showing purchase and sale

Gift Rules (Critical for Family Help):

- From Parents: Generally accepted without tax implications up to reasonable amounts

- From Siblings/Extended Family: May trigger gift tax questions; consult your lawyer

- From Non-Family: Almost always rejected unless exceptional documentation provided

- The Paper Trail: Money must move: Donor’s Account → Your Foreign Account → Your Israeli Account (with clear wire transfer records at each step)

The “Equity Release” Strategy for Serial Investors

Advanced investors use a strategy called mashkanta mishtalmut (paying-off mortgage):

- Buy Property A with 50% down

- After 2-3 years of appreciation, refinance Property A at 50% of NEW value

- Use released equity as down payment for Property B

- Repeat

Warning: Each property after the first requires 50% down minimum, and interest rates increase with each additional property. Banks also look at total DTI across all properties.

Chapter 9: Property Types Decoded: Apartments, Cottages, “On Paper,” and More

The Israeli property market has unique property types and purchase methods you won’t find elsewhere. Let’s decode each one.

Standard Property Types

- Standard Apartment (Dira Regulárit)

- What it is: A unit in a multi-story building with shared ownership of common areas

- Key Features: Usually includes a mamad (reinforced security room), parking space, and storage room (machsan)

- Ownership Structure: You own your unit + percentage of common areas based on your apartment’s relative size

- Garden Apartment (Dirat Gan)

- Premium of 15-30% over standard apartments

- Critical Legal Point: You don’t “own” the garden—you have exclusive usage rights (zchut shimush bel’adit)

- Check the Tabu: Garden rights must be explicitly registered, not just mentioned in the contract

- Penthouse (Penthouse)

- Two Types:

- Mini-Penthouse: Top floor unit with large balcony

- Full Penthouse: Entire top floor, often with roof rights

- Roof Rights (Zchuyot Gag): Can be worth ₪500k-₪2M in central areas; verify if included

- Cottage (Kotej)

- Definition: Single-family home sharing one or more walls with neighbors

- Land Ownership: Usually includes actual land ownership (not just usage rights)

- HOA Factor: Still subject to neighborhood va’ad with monthly fees

Buying “On Paper” (Al HaNiyar): The Developer Purchase Deep Dive

Buying from a developer (kablan) before or during construction is common but complex.

The Process Timeline:

- Signing (Month 0): Sign contract with developer, pay 20% down

- Construction (Months 1-24): Make payments according to construction milestones

- Form 4 (Month 20): Municipality issues occupancy permit

- Delivery (Month 24-30): Final payment, receive keys

- Registration (Month 30-36): Developer registers property in your name

Payment Schedule (Standard Israel Land Authority Model):

- Upon signing: 20%

- Foundation complete: 15%

- Frame complete: 15%

- Walls & Windows: 15%

- Flooring & Infrastructure: 15%

- Form 4 Issued: 15%

- Key Delivery: 5%

Critical Protections Under the Sale Law (Apartments):

- Bank Guarantee (Arvut Banka’it): The developer MUST provide a bank guarantee for every shekel you pay before delivery. This protects you if the developer goes bankrupt.

- Specification Sheet (Mifrat): A detailed, legally binding document listing every item in your apartment:

- Floor type and quality level

- Kitchen cabinet linear meters

- Appliance brands and models

- Plumbing fixture specifications

- Electrical outlet locations

Pro Tip: Negotiate upgrades BEFORE signing. Post-signature changes cost 3-5x more.

- Penalty Clauses:

- Developer Delay: 1.5% of purchase price per month after agreed delivery date

- Your Payment Delay: 8-9% annual interest (much higher)

The TAMA 38 Opportunity & Complexity

TAMA 38 is Israel’s National Outline Plan for earthquake reinforcement, but it’s become a massive urban renewal engine.

Two TAMA Types:

TAMA 38/1 – Reinforcement:

- Building is reinforced, owners get 25sqm addition + balcony

- Timeline: 12-18 months

- You continue living there during construction (nightmare)

- Cost: Usually “free” (developer profits from adding floors)

TAMA 38/2 – Demolish & Rebuild (Pinui Binui):

- Entire building demolished and rebuilt

- Owners get 25-40% larger apartments

- Timeline: 3-5 years

- You must relocate (developer pays rent)

Buying into a TAMA Building – The Analysis:

Pros:

- Discount of 10-20% due to uncertainty

- Massive value increase post-project (30-50%)

- Brand new apartment in established neighborhood

Cons:

- Timeline uncertainty (often delayed by years)

- Construction nightmare if TAMA 38/1

- Requires 80% owner approval (can fail)

- Capital gains tax event for sellers

Due Diligence Questions:

- What percentage of owners have signed?

- Is the developer signed and who are they?

- What’s the exact timeline and penalty structure?

- For 38/1: What’s the noise mitigation plan?

- For 38/2: What’s the rental payment during construction?

Special Zones: Judea & Samaria Properties

Properties in settlements (yishuvim) across the Green Line have unique considerations:

Legal Structure:

- Not standard Israeli law but military law

- Registration through the Civil Administration, not regular Tabu

- Some banks won’t provide mortgages; others specialize in it

Price Differential:

- 30-50% cheaper than comparable properties inside Green Line

- Example: 4-room in Ariel (₪1.2M) vs. Petach Tikva (₪2.5M)

Additional Considerations:

- Security infrastructure included

- Tighter community acceptance committees

- Limited resale market

- International travel insurance may not cover

- Some foreign banks won’t accept as collateral

Chapter 10: Buying vs. Renting: The Definitive Financial Analysis

The rent vs. buy decision in Israel has unique dynamics driven by cultural factors, tax law, and market conditions.

The Numbers: A Real-World Financial Model

Let’s analyze a realistic scenario: A ₪2,500,000 apartment in Ra’anana.

Scenario A: Buying

- Purchase Price: ₪2,500,000

- Down Payment (First-time buyer): ₪625,000 (25%)

- Mortgage: ₪1,875,000

- Interest Rate (weighted average): 5.5%

- Monthly Mortgage Payment: ₪10,850

- Monthly Va’ad Bayit: ₪400

- Monthly Arnona: ₪1,000

- Total Monthly Cost: ₪12,250

Scenario B: Renting the Same Apartment

- Monthly Rent: ₪8,500

- Annual Increase: 3%

- No equity building

- Total Monthly Cost: ₪8,500

The 10-Year Projection

Buying After 10 Years:

- Total Payments: ₪1,470,000

- Principal Paid Down: ₪420,000

- Remaining Mortgage: ₪1,455,000

- Assumed Property Value (3% annual appreciation): ₪3,355,000

- Net Equity: ₪1,900,000

Renting After 10 Years:

- Total Rent Paid: ₪1,152,000

- Equity Built: ₪0

- Investment of Down Payment (₪625,000 at 6% annual return): ₪1,118,000

- Net Position: ₪1,118,000

The Verdict: In this scenario, buying creates ₪782,000 more wealth over 10 years.

The Hidden Factors That Change Everything

- The Rental Yield Reality

- Israeli rental yields are LOW: 2.5-3.5% annually

- Why? Cultural preference for ownership keeps rental supply limited but also caps rental prices

- Investors often accept low yields for appreciation potential

- Tax Advantages of Ownership

- No Property Tax on Primary Residence: Unlike the US, there’s no annual property tax on your primary home beyond modest Arnona

- Capital Gains Exemption: Selling your primary residence is tax-free (once every 4 years)

- No Imputed Rental Income: Unlike some countries, Israel doesn’t tax you on the “benefit” of living in your own home

- The Rental Market Challenges

- Annual Contracts: Most rentals are 12-month contracts with annual increases

- Landlord Power: 2-3 months notice to vacate is standard

- Limited Protection: Minimal tenant rights compared to Europe

- Maintenance Issues: Landlords often slow to repair; you have little recourse

The Psychological & Social Factors

Israeli Cultural Reality:

- Homeownership = Adult Success Marker

- Renting past age 35 carries social stigma

- Parents often help with down payments (cultural expectation)

- “Renting is throwing money away” deeply ingrained belief

The Flexibility Myth:

- Job mobility within Israel is high but geographic mobility is low

- Most Israelis stay within 30km of where they grew up

- “Flexibility” of renting rarely utilized in practice

When Renting Makes Sense in Israel

- Temporary Residents (<3 years)

- Diplomatic/Corporate Assignments (company pays rent)

- Waiting for Specific Development (new neighborhood/city being built)

- During TAMA 38/2 (developer pays your rent)

- Extreme Market Peaks (2021-2022 was arguably one)

The Opportunity Cost Calculator

Here’s the formula to determine your break-even:

Monthly Ownership Cost – Monthly Rent = Monthly Premium

If Monthly Premium × 12 ÷ Purchase Price < 3%, buying likely wins long-term.

Example: (₪12,250 – ₪8,500) × 12 ÷ ₪2,500,000 = 1.8%

Since 1.8% < 3%, buying is financially favorable assuming modest appreciation.

Chapter 11: Is It TRULY Hard to Buy a House in Israel?

Let’s address the elephant in the room with brutal honesty.

The Difficulty Scale: Global Comparison

On a difficulty scale of 1-10 (10 being hardest), here’s how Israel compares:

Country | Difficulty Score | Why |

Singapore | 9/10 | Extreme prices, foreign restrictions |

Israel | 7/10 | Complex process, language barriers, high costs |

United Kingdom | 5/10 | Established process, but chains and gazumping |

United States | 4/10 | Straightforward but varies by state |

Dubai | 3/10 | Foreign-friendly, simple process |

What Makes It Challenging: The Unvarnished Truth

- The Language & Cultural Barrier

- All contracts are in Hebrew (legal requirement)

- “Israeli directness” can feel like rudeness

- Negotiation style is aggressive by Western standards

- “Protekzia” (connections) still matters

- The Bureaucratic Maze

- Average transaction involves 8-12 different entities

- Government offices have limited hours (close at 1 PM)

- Digital systems exist but aren’t fully integrated

- “Come back tomorrow” is a national phrase

- The Speed Paradox

- Sellers want decisions IMMEDIATELY

- But closing takes 60-90 days minimum

- “Urgent” and “Take your time” coexist confusingly

- The Trust Deficit

- “Verify everything twice” is survival mode

- Verbal agreements worth nothing

- Even written agreements need lawyer verification

- Everyone assumes everyone else is trying to screw them

What Makes It Easier Than You Think

- The Professional Infrastructure

- Real estate lawyers are excellent and affordable

- Mortgage brokers are sophisticated

- The system, while complex, is well-established

- Thousands of immigrants do it successfully annually

- The Anglo Bubble

- English-speaking professionals everywhere

- Entire agencies specialize in foreign buyers

- WhatsApp groups with thousands of members helping each other

- You’re never the first to face any problem

- The Legal Protections

- Sale Law (Apartments) provides strong buyer protection

- Court system generally favors buyers over sellers

- Registered ownership is rock-solid

- Title insurance rarely needed (unlike the US)

Difficulty by Buyer Type

Easiest → Hardest:

- Oleh Chadash with Savings (4/10)

- Maximum benefits and tax breaks

- Entire support system designed for you

- Cultural acceptance of “new immigrant learning curve”

- Israeli Return Resident (5/10)

- Know the system but lost some benefits

- Network likely still exists

- Language no barrier

- Jewish Foreign Buyer (6/10)

- Legal rights nearly identical to citizens

- Cultural familiarity helps

- Community support available

- Non-Jewish Foreign Cash Buyer (7/10)

- Money solves many problems

- No mortgage complexity

- But less community support

- Non-Jewish Foreign Buyer Needing Mortgage (9/10)

- Maximum complexity

- Least favorable terms

- Minimal cultural/community support

The Success Factors: What Separates Winners from Strugglers

Winners:

- Budget 20% more time and money than expected

- Hire the best lawyer, not the cheapest

- Learn 50 Hebrew words related to real estate

- Join 3-5 relevant Facebook/WhatsApp groups

- Accept that some inefficiency is cultural, not personal

- Maintain sense of humor about the absurdities

Strugglers:

- Try to do it themselves to save money

- Fight the system instead of working within it

- Take aggressive negotiation personally

- Expect American/European efficiency

- Trust verbal agreements

- Cheap out on professional help

The Mindset Shift Required

From: “This should be simple and straightforward” To: “This is complex but manageable with help”

From: “Why is everyone trying to screw me?” To: “This is how negotiation works here”

From: “The seller/agent is lying” To: “Trust but verify everything”

From: “This is taking forever” To: “3 months is actually pretty fast”

Chapter 12: Your Next Steps & Post-Purchase Checklist

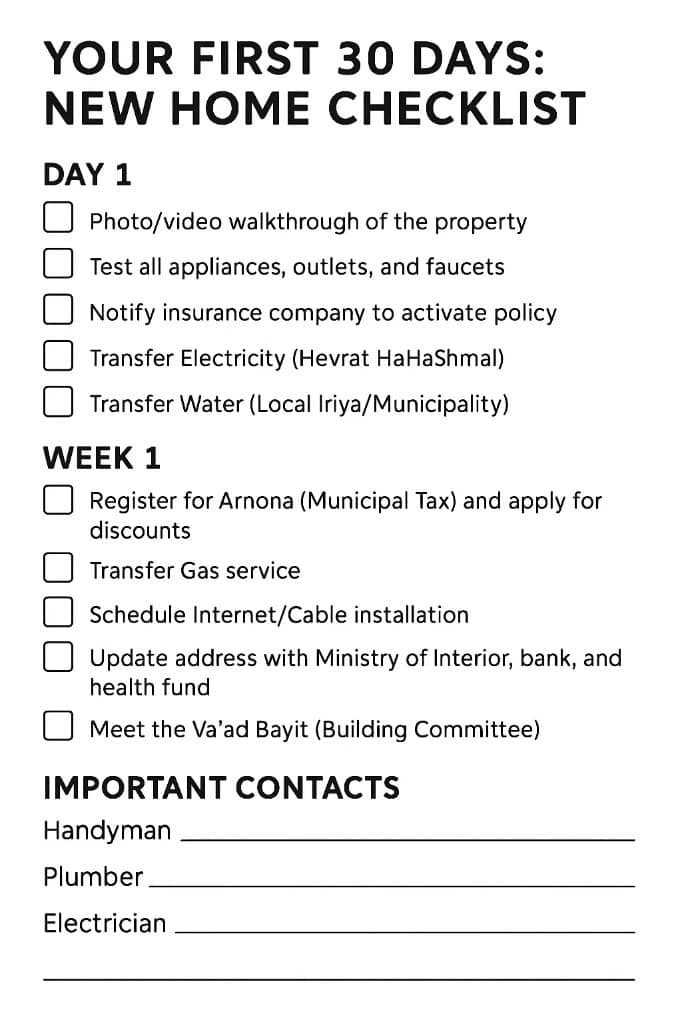

You’ve got the keys. Now what? The journey isn’t over—here’s your complete post-purchase roadmap.

Immediate Actions (First 48 Hours)

Hour 1-4: The Walk-Through

- Document EVERYTHING with photos/video

- Test every appliance, outlet, faucet

- Check for issues not noticed during inspections

- List any problems for seller/developer

Day 1: Critical Notifications

- Notify your insurance company (home insurance starts TODAY)

- Call your lawyer to confirm registration process started

- Inform your mortgage bank of possession

Day 2: Utility Transfers

Electricity (Israel Electric Corporation):

- Call 103 or use app

- Provide: ID, contract, meter reading

- Set up automatic payment (hora’at keva)

Water (Local Municipality):

- Visit municipal office (iriya)

- Bring: Contract, ID, bank details

- Update to your name immediately (avoid previous owner’s debts)

Gas (If Applicable):

- Central gas: Contact building va’ad

- Private tank: Contact Pazgas/Amigas

- Schedule safety inspection

Internet/Cable:

- Compare: Bezeq, Hot, Partner, Cellcom

- Fiber availability varies by building

- Installation can take 1-3 weeks

First Month Essentials

Week 1: Legal & Financial

- Arnona (Property Tax) Registration:

- Visit municipality with contract

- Apply for discounts: New immigrant (90% Year 1), single parent, senior, etc.

- Set up monthly payment plan

- Update Your Address:

- Ministry of Interior (ID card)

- Bank accounts

- Bituach Leumi (National Insurance)

- Health fund (kupat cholim)

- Driver’s license

- Va’ad Bayit Integration:

- Meet the va’ad (building committee) chairman

- Get WhatsApp group details

- Understand monthly fees and what’s included

- Learn building rules (takanon)

Week 2-3: Maintenance & Safety

Create Maintenance Schedule:

- A/C filter cleaning (quarterly)

- Dud (water heater) maintenance (annually)

- Mamad (safe room) ventilation system check

- Mezuzah installation (if not present)

Security Setup:

- Change locks (₪500-1500)

- Install alarm system if desired

- Check smoke detectors

- Verify Mamad door seals properly

Week 4: Community Integration

Get to Know:

- Nearest grocery stores and their Shabbat hours

- Local synagogues/churches

- Schools and ganim (kindergartens)

- Healthcare facilities

- Public transport routes

Understanding Your Rights & Obligations in a Building

Your Rights:

- Quiet enjoyment of your property

- Participation in va’ad decisions

- Access to financial records

- Vote on major renovations

Your Obligations:

- Pay va’ad fees on time

- Maintain your property

- Don’t damage common areas

- Follow building rules

- Contribute to major repairs (by percentage ownership)

The Annual Property Checklist

Every Year You Should:

- Review Insurance Coverage

- Building structure (usually via va’ad)

- Contents (your responsibility)

- Third-party liability

- Earthquake coverage (recommended)

- Tax Filings

- Report rental income if renting out

- Update Arnona discounts if status changed

- Keep all property-related receipts

- Maintenance Tasks

- Professional A/C service

- Plumbing inspection

- Electrical panel check

- Roof/balcony waterproofing (every 3-5 years)

If You’re Renting It Out

Legal Requirements:

- Register with tax authority within 30 days

- Provide tenant with rental agreement

- Give rent receipts

- Maintain property to livable standard

Tax Options:

- 10% flat tax on rental income (no deductions)

- OR marginal tax rate with deductions

- Exemption up to ₪5,100/month (2025 rate) if only property

Property Management:

- DIY: Keep 100% but handle everything

- Management company: 1 month’s rent + 5-10% monthly

- Worth it for foreign owners or multiple properties

Building Your Israeli Property Network

Essential Contacts to Cultivate:

- Handyman (Avi La’kol): For small repairs

- Plumber (Installator): Emergency leaks

- Electrician (Chashmalai): Electrical issues

- A/C Technician: Seasonal maintenance

- Locksmith (Manulai): Lockout emergencies

- Painter (Tzaba): Refresh every 3-5 years

Where to Find Them:

- Building WhatsApp group recommendations

- Local Facebook groups

- Yad2 services section

- Ask your va’ad

Chapter 13: Expanded FAQ Section

Advanced Financial Questions

Q: What is Betterment Tax (Hetel Hashbacha)?

A: This is a capital gains tax on property sales that catches many people off-guard. Here’s the complete breakdown:

- Rate: 25% of the profit (with some exceptions)

- Exemption: Once every 4 years when selling your primary residence

- Calculation: Sale Price – (Purchase Price + Improvements + Indexed for Inflation)

- Payment: Due within 60 days of sale

- Foreign Residents: No exemption; always pay the tax

Q: Can I get a mortgage based on foreign income?

A: Yes, but it’s complex:

- Bank will typically recognize 70% of foreign income

- Required documents: 3 years tax returns, letter from employer, 6 months pay stubs

- Currency risk: Bank assumes 10-15% volatility

- Some banks specialize: Mizrahi Tefahot, Bank Hapoalim International

Q: What’s the deal with “key money” (dmei mafteach)?

A: A relic from rent-control era, still exists in some older buildings:

- One-time payment to previous tenant for “right” to rent

- Can be ₪50,000-₪200,000 in Tel Aviv

- Legally gray area but widely practiced

- If you pay it, get a receipt and lawyer involvement

Legal Complexities

Q: What happens if I discover an illegal addition after purchase?

A: This is more common than you’d think:

- You own it “as-is” – can’t cancel the sale

- Options:

- Legalize it (₪50k-₪200k process, not always possible)

- Leave it (risk municipality demolition order)

- Remove it (your cost)

- Can potentially sue seller if they actively hid it

- Prevention: Always do thorough due diligence

Q: Can I Airbnb my property?

A: Yes, but:

- Must register as business with tax authority

- Many buildings prohibit in their takanon

- Some cities require permits

- Income taxed at marginal rate (no 10% option)

- Insurance often doesn’t cover short-term rentals

Q: What if the seller dies before closing?

A: Surprisingly common question:

- Contract remains valid

- Heirs must honor it

- May delay closing 3-6 months

- Requires additional legal documentation

- Your lawyer handles via probate court

Market Timing & Strategy

Q: When is the best time of year to buy?

A: Israeli market seasonality:

- Best for Buyers: August (summer vacation), December-January (holidays)

- Most Inventory: March-May, September-November

- Avoid: Rosh Hashana to Sukkot (everything stops)

- Foreign Buyer Advantage: Israeli holidays when locals aren’t looking

Q: Should I wait for prices to drop more?

A: The eternal question. Consider:

- Waiting cost: Rent + potential appreciation missed

- Historical data: Major drops are rare (2003, 2008, brief 2023 dip)

- If you find the right property at a fair price, timing matters less than you think

- Perfect timing is impossible; “good enough” timing is achievable

Q: How do I spot a problematic building?

A: Red flags to watch for:

- Excessive “For Sale” signs (why is everyone leaving?)

- Deferred maintenance visible from street

- Ongoing legal disputes (check court records)

- No building insurance (huge red flag)

- Dysfunctional va’ad (ask to see meeting minutes)

- Major renovation assessments coming

Special Situations

Q: Can I buy with cryptocurrency?

A: Technically possible but practically difficult:

- Must convert to fiat for official transaction

- Bank will scrutinize source extensively

- Tax authority assumes capital gains occurred

- Only a handful of lawyers familiar with process

- Expect 2-3 month additional delays

Q: What about buying with other family members?

A: Common but complex:

- Decide ownership percentages upfront

- Create written agreement beyond standard contract

- Consider: What if someone wants out? Dies? Divorces?

- Tax implications vary by relationship

- Strongly recommend separate lawyer from other parties

Q: Can I buy through a company?

A: Yes, but usually not recommended:

- Purchase tax: Always maximum rate (8-10%)

- Annual property tax (mas rechush) applies

- No primary residence exemptions

- Complex accounting requirements

- Only makes sense for serial investors or special situations

Horror Stories & How to Avoid Them

Q: What’s the worst that can realistically happen?

A: The nightmare scenarios and prevention:

- Buying a property with hidden debt: Previous owner’s debts can attach to property

- Prevention: Lawyer must check all liens thoroughly

- Developer goes bankrupt mid-construction: You lose your money

- Prevention: Only buy with full bank guarantees

- Massive assessment after purchase: Va’ad votes ₪200k renovation per apartment

- Prevention: Review va’ad minutes for 3 years prior

- Title never transfers: Seller can’t/won’t complete transfer

- Prevention: Escrow payments through lawyer

- Property is uninhabitable: Major hidden defects discovered

- Prevention: Professional inspection, even for new properties

Conclusion: Your Israeli Property Journey Starts Now

Congratulations. You’ve just absorbed more detailed information about buying property in Israel than 99% of buyers ever will.

Yes, the process is complex. Yes, there will be moments of frustration. But armed with this knowledge, you’re not just prepared—you’re overqualified.

Your Action Plan

If you’re 12+ months from buying:

- Start building your Israeli credit history

- Join online communities and observe

- Visit different neighborhoods

- Start learning basic Hebrew real estate terms

If you’re 6-12 months from buying:

- Interview lawyers and mortgage brokers

- Get your financial documents organized

- Obtain mortgage pre-approval

- Define your must-haves vs. nice-to-haves

If you’re ready to buy now:

- Assemble your professional team immediately

- Get pre-approved this week

- Start viewing properties with clear criteria

- Be prepared to move quickly when you find “the one”

The Final Truth

Thousands of people successfully purchase homes in Israel every year. They’re not smarter than you. They’re not better connected. They simply took the first step.

Your dream of owning a piece of this remarkable country isn’t just possible—with this guide, it’s probable.

The question isn’t whether you can buy a home in Israel.

The question is: When will you start?

Welcome to your journey toward Israeli homeownership.

!בהצלחה (Good luck!)